Macro-Economic Overview

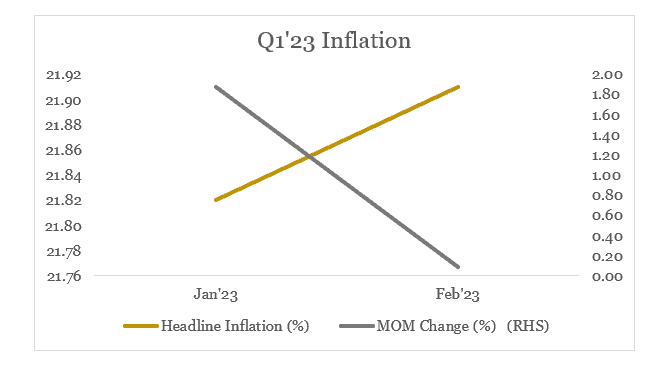

- This quarter Nigeria’s inflation continued its upward trajectory, to close at 21.91% as at February 2023. This hike was partly due to the scarcity of the redesigned Naira notes and amid persistent food shortages.

- In a bid to combat the elevating inflation, the MPC hiked MPR by 100bps and 50bps in the Jan’23 and Mar’23 meetings respectively, while retaining the asymmetric corridor of the MPR at +100 / -700 basis point, Liquidity ratio at 30%; and CRR at 32.5%.

- Oil prices this quarter averaged $82.16/b, hitting a low of $72.97 on March 17 following demand worries. The quarter commenced with prices at c.$85.91/b as economies continued to navigate the Russia-Ukraine crisis. Brent crude closed the quarter c.7.15% down at $79.77/b.

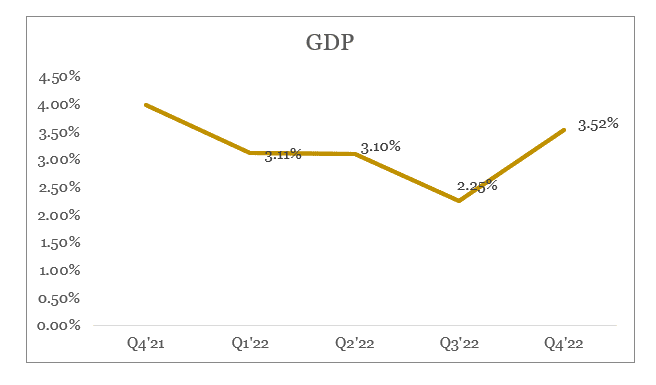

- Nigeria’s gross domestic product (GDP) grew by 3.52% year-on-year in real terms in the fourth quarter of 2023, an improvement compared to the 2.25% growth recorded in the previous quarter.

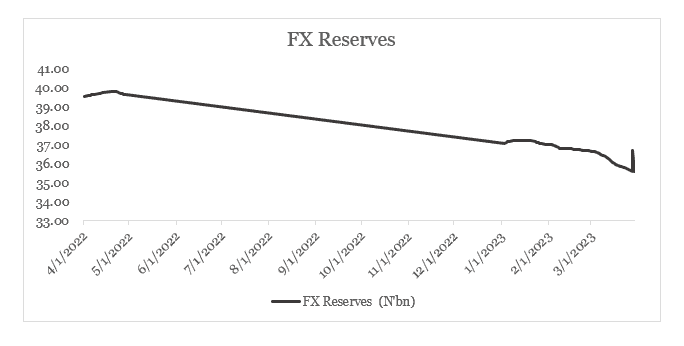

- The Nigerian FX reserve declined by 2.52% to close at $35.57bn, as crude oil prices trend downwards amid global economic worries.

- Interbank liquidity this quarter averaged N427.95bn, however, closing the quarter at repo c.200bn banks funded for their CRR and Retail SMIS auction debits.

- Total FAAC disbursement for the quarter was N1.47tn with N750.174bn and N722.677bn for Jan. and Feb disbursements respectively.

Bond market

On the back of the hawkish stance of the CBN and the relatively low system liquidity during the quarter, bond yields rose by an average of 52bps. Q1 commenced on a relatively quiet note as most participants remained on the sidelines. This was followed by mixed sentiments, albeit with a bullish bias mid-quarter, as players looked to sterilize liquidity. Closing the quarter, the bears were prevalent in reaction to the significant move in the last NTB stop rate and amid the liquidity dearth.

During the quarter, the DMO offered a total of N1.08trn, but sold c. N1.994trn on the 2028s, 2032s, 2037s and 2049s. The 2029 paper was replaced with the 2028 and the 2049 paper was re-introduced by the DMO at the first auction of the quarter. Stop rates declined across the spectrum except the 28s which closed the quarter at same level of 14.00%; the stop rate for the February auction was however slightly lower at 13.99%. The 32s maintained it’s 14.90% stop rate for the first two auctions, then declined to 14.75% to close the quarter. Stop rates for the 37s were at 15.80%, 15.90% and 15.20% respectively while the 49s closed at 15.90%, 16.00% and 15.75% respectively.

Treasury bill market

The treasury bill market was largely bullish in the first quarter of the year, owing to persistent system liquidity and high instrument demand. The NTB auctions were heavily subscribed, save for the last auction conducted in the quarter, which recorded low subscription due to the depressed level of liquidity in the system (N168.53bn as against the N1.03trn subscription at the previous auction).

Bearish sentiments were observed near the end of the quarter due to a variety of factors such as a delay in FAAC payment, CRR debit, and FX retail auction as market participants sought liquidity to meet these obligations. Thus, due to the persistent selloffs at the end of the quarter, yields inclined Q-o-Q by an average 236bps.

Bullish sentiment in the OMO market was driven throughout the quarter by improved system liquidity, with the May and Dec bills being the most traded.

Eurobond Market

As the US Fed continued its rate hikes (2x 25bps), investors fled to safety to the greenback. While the Fed signaled a determination to maintain its hawkish stance, a slowdown is evident in the (2x) quarter points delivered this quarter. This became even more important as reported events of bank failures led to intervention by the Fed. The reduced US inflation, limited supply of SSA Eurobonds (as they are shut out of the market due to high yields), as well as peculiar country factors led to a couple instances of rally on these papers, while overall bearish sentiment prevailed.

Country event

Nigeria

Yields on the Nigerian Eurobond papers climbed by 49bps on average this quarter. Moody’s rating downgrade of the Nigerian government (to Caa1 from B3) at the end of January led to selloffs especially on longer-dated bonds, while a few speculative investors picked up the attractive offers as a result. Before its conclusion, uncertainty surrounding the outcome of the general election led to volatility, after which normalcy was restored.

Ghana

Activity on the Ghana Eurobond papers was driven largely by developments on the road to a debt solution. While the gold coast is far from clear, Ghana had talks during the quarter with creditors on the continent and beyond, most notably their Chinese creditors. The approval of the $3billion IMF bailout it requests depends on a successful restructuring of its $47.6billion debt. This went on alongside efforts to ramp up government revenue, most recent being the tax bills to be passed to increase revenue by $340 million this year. To combat surging inflation which fell 80bps in February, Ghana went ahead to deliver the world’s biggest rate hike so far (150bps) this year. Yields on its Eurobond papers thus expanded by over 300bps on average this quarter.

Kenya

Compared to its peers, the resilience of the Kenyan economy led to mild overall bearishness in Q1 2023, thus leading to yields expanding by a meagre c. 100bps in the quarter. In a surprising turn of events to address the four-year high core inflation of 4.3% in January, benchmark interest rates were increased by 75bps in March, which led to gains on the KENINT Eurobond papers. While the going appears to be positive for Kenya, increasing public debt, reserves depletion and its imminent repayment of its $2 billion 2024 maturity presents reasons for scrutiny on its fiscal position.

Zambia

Zambia’s woes on its debt restructuring efforts drove sentiment this quarter. With yields climbing over c. 2,000bps, it can be said that progress has hardly been made. China being the single largest creditor (40%) of Zambia’s external debt, restructuring efforts leverages with them and has been delayed. Until Zambia is able to resolve the impasse, it will be unable to access the $1.3 billion IMF bailout it seeks.

Q3 2023 Outlook

- Due to the anticipated influx of liquidity in the second quarter of 2023, we anticipate an downward trend in treasury bill yields.

- As we approach the ceiling of US Fed benchmark rates, we expect a less bearish quarter, as investors will begin to plot their entry back into the SSA Eurobond market.