This Q2 2023 Fixed Income (FI) Report provides comprehensive insight happenings in the Global Financial Markets in the second quarter of 2023 and delves into the dynamics of the bond market, treasury bill market, and sub-Saharan Africa Eurobond market. In the report, we cover key indicators such as inflation, GDP growth, FX reserves, and liquidity, with a forecast on trends, challenges, and opportunities that will shape the FI market outlook for Q3 2023.

Macro-Economic Overview

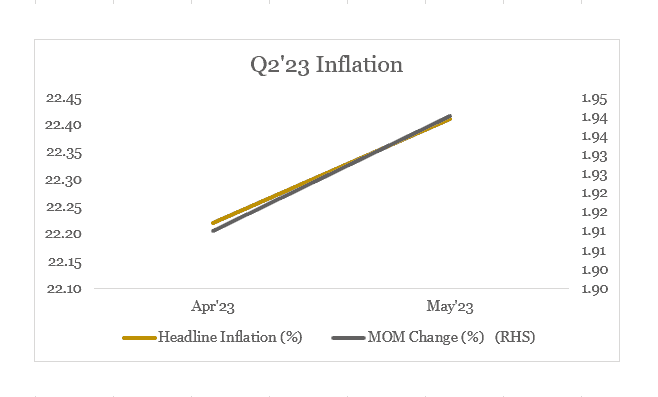

Nigeria’s inflation continued to trend upwards, reaching 22.41% in May, a c.37bps increase from figures as at the end of Q1 2023.

To offset the moderate increase in headline inflation, the MPC raised the MPR to 18.5% from 18.0% while retaining the symmetric Corridor of +100/-700 basis points, the Liquidity Ratio and CRR at 30% and 32.5% respectively.

Oil prices this quarter hovered around $71-$87/barrel throughout the quarter, hitting a low of $71.84/b on 12th June when Saudi cuts failed to support prices amid US growing inventories. Brent crude oil closed the quarter at $74.87/b.

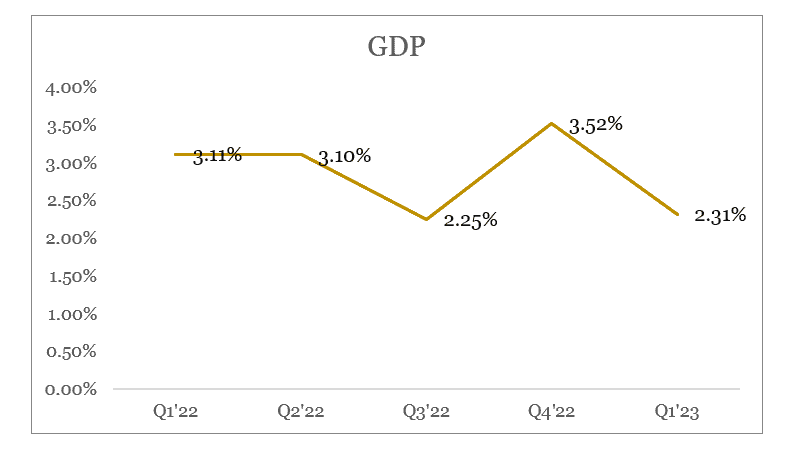

Nigeria’s Gross Domestic Product (GDP) grew by 2.31% (year-on-year) in real terms in the first quarter of 2023. This growth rate declined from 3.11% recorded in the first quarter of 2022, and 3.52% in the fourth quarter of 2022.

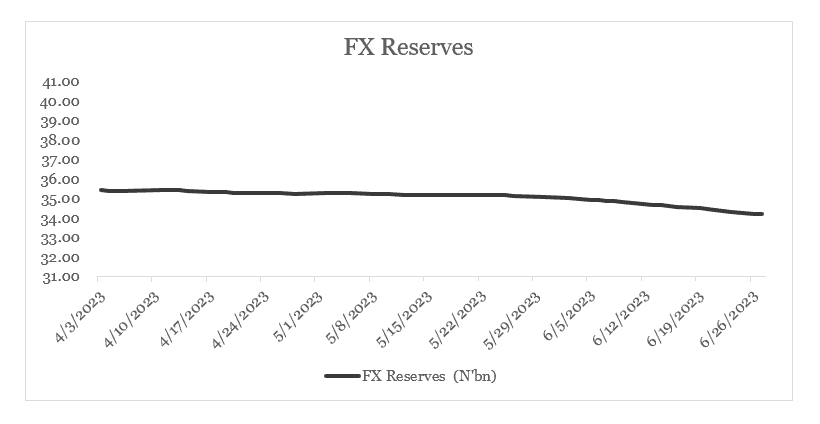

The Nigerian FX reserve declined by 2.52% to close at $35.57bn, as crude oil prices trend downwards amid global economic worries.

Interbank liquidity closed the quarter at c.N1.15trn after the system experienced illiquidity in April and part of May 2023.The growth in liquidity was fueled by the CRR debits by the Central Bank and the FAAC inflows towards the end of June.

Total FAAC disbursement for the quarter was 1.442 trillion with N655.932Bn for April and N786.1Bn for May respectively.

This quarter, the DMO sold c.N1.172trn across the standard treasury bills maturities and c.N1.996trn across issued bond tenors.

Bond market

Looking at Q2, the bond yields declined by an average of 166bps quarter to date. The period started off with bearish bias prevailing amid thin level of liquidity. However, it moved on to a bullish state as market players sought to take advantage of high yields, alongside utilizing excess funds in the system, driven by the CRR refunds.

In the last month of the quarter, the DMO replaced the 2028, 2032, 2042 and 2050 papers, with the 2029, 2033, 2038 and 2053s; of which the 33s, 38s and 53s were new issues. We saw the new issues open at 14.70%, 15.45% and 15.70% respectively. During the period, a total of N1,080bn was offered, with N1,163.98bn being allotted on the 2028, 2029, 2032, 2033, 2038, 2042, 2050 and 2053 papers.

Treasury bill market

Bearish sentiments dominated the treasury bills market at the beginning of the quarter, owing to a number of factors including CRR debit, and FX retail auction as market participants sought liquidity to meet their obligations. However, the market regained its bullishness as system liquidity increased due to CBN swap maturity and FAAC inflow c.468bn.

Save for the first auction of the quarter, the NTB auctions were heavily subscribed, as a result of high system liquidity, with the last auction recording a 566.35bn oversubscription, and stop rates dropping significantly by 161bps, 62bps, and 176bps, respectively.

Thus, due to the persistent buy interest at the end of the quarter, yields declined Q-o-Q by an average 133bps.

Eurobond Market

The sub-Saharan Africa Eurobond market remained bearish in Q2 2023, as investors continued to flee to safety in the US dollar. The ongoing war in Ukraine, rising inflation, and concerns about global economic growth have all contributed to a bearish sentiment in the sub-Saharan African Eurobond market in Q2 2023.

The US Federal Reserve continued to raise interest rates in Q2 (1x 25bps), although having slowed from 2x 25bps in Q1 2023. Inflation in the United States, although having dropped 200bps from February 2023 to May 2023, remained high relative to the 2.00% target of the US Fed. This led to a stronger US dollar and higher yields on US Treasuries, which made sub-Saharan African Eurobonds less attractive to investors.

No new Eurobond issuances. No sub-Saharan African countries issued new Eurobonds in Q2 2023. This is in contrast to Q1 2022, when two countries (Nigeria and Angola) issued new Eurobonds.

Country event

Nigeria

Yields on Nigerian Eurobonds continued to climb in Q2 2023, reaching a record high of 12.5%. This was due to a number of factors, including the country’s high debt levels, the ongoing political uncertainty, and the global economic slowdown. Nigerian papers however enjoyed some respite, when market received the news of the new administration and its policies (notably the fuel subsidy removal) positively with short-term rallies to follow.

Ghana

Yields on Ghanaian Eurobonds also rose in Q2 2023, reaching a high of 14.5%. This was due to the country’s ongoing debt crisis and the uncertainty surrounding the IMF bailout. Ghana’s credit rating suffered yet again, as Fitch downgraded its Long-Term Local-Currency (LTLC) Issuer Default Rating (IDR) to ‘RD’ (restricted default) from ‘CCC’ (substantial credit risk), due to missed local-currency debt payment, uncertainty regarding clearing of missed payments and critical solvency concerns.

Kenya

Yields on Zambian Eurobonds continued to climb in Q2 2023, reaching a record high of 2,500bps. This was due to the country’s ongoing debt crisis and the uncertainty surrounding the IMF bailout. The IMF and the Zambian authorities have however reached a staff-level agreement, as structural benchmarks and quantitative performance criteria for the first review have been met.

Zambia

Yields on Zambian Eurobonds continued to climb in Q2 2023, reaching a record high of 2,500bps. This was due to the country’s ongoing debt crisis and the uncertainty surrounding the IMF bailout. The IMF and the Zambian authorities have however reached a staff-level agreement, as structural benchmarks and quantitative performance criteria for the first review have been met.

Q3 2023 Outlook

- Due to the anticipated influx of liquidity in the third quarter of 2023, we anticipate an downward trend in treasury bill yields.

- The outlook for the sub-Saharan Africa Eurobond market in Q3 2023 is uncertain. Some analysts believe that the market may bottom out in Q3, as investors start to look for yield elsewhere. Others believe that the market will remain bearish, as investors continue to focus on the risks in the global economy.

The key factors that will affect the sub-Saharan Africa Eurobond market in Q3 2023 include:

- The war in Ukraine could continue to weigh on sentiment in the market. The war in Ukraine is a major uncertainty for the global economy, and it could continue to weigh on sentiment in the sub-Saharan African Eurobond market in Q3 2023.

- The direction of the global economy. If there are signs of improvement in global economic growth, this could also help to boost investor confidence in sub-Saharan African Eurobonds.

- Rising inflation could also put pressure on the market. Rising inflation is a concern for many investors, and it could lead to further downgrades of sub-Saharan African countries’ credit ratings. This could make it even more difficult for countries to raise new debt in the market.

- The pace of interest rate hikes in the United States. The US Federal Reserve is expected to begin to slow the pace of interest rate hikes in Q3 2023. This could lead to some relief for investors who have been fleeing to safety in the US dollar.

- The progress of debt restructuring efforts in sub-Saharan Africa.

Overall, the sub-Saharan Africa Eurobond market remains challenging in Q2 2023. The high yields on existing Eurobonds and the risk of further downgrades make it difficult for countries to raise new debt. However, some countries with strong economic fundamentals could still access the market in the future.