March Inflation Forecast: Disinflationary Trend Continues

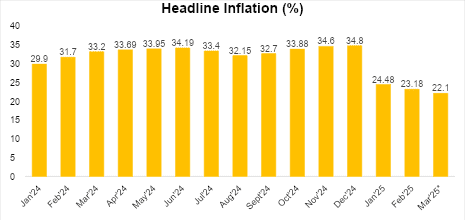

The National Bureau of Statistics (NBS) is set to release the March 2025 Consumer Price Index (CPI) report today, April 15. According to our model-based forecasts, headline inflation is expected to ease further to 22.1% year-on-year, down from 23.18% in February. If our projections are accurate, it would mark the second consecutive monthly decline since the CPI was rebased, signaling a gradual deceleration in annual price growth.

This moderation is primarily attributed to base effects and the relative stability of the naira, which has helped curb imported inflation. Additionally, transportation costs remained largely unchanged, as the effect of the PMS price adjustment, following the temporary suspension of the Naira-for-Crude policy was contained.

On the flip side, month-on-month inflation is projected to rise slightly to 2.17% from 2.04% in February, reflecting seasonal food supply constraints as the harvest season thins out and we gradually approach the planting season. Field surveys conducted in March indicated price increases in key staples such as tomatoes, peppers, and yams.

Global and Regional Inflation Trends: A Mixed Picture

Globally, major economies continued to experience disinflation in March. The U.S. and Eurozone posted year-on-year inflation rates of 2.4% and 2.2%, respectively. This is the second straight month of decline, largely driven by weaker energy prices.

In contrast, inflationary pressures remain more persistent across much of Africa. Of the 19 African countries that have released March inflation data, 11 reported an increase, underscoring the ongoing challenges of structural inflation in the region. Only 6 countries recorded declines, while 2 economies are witnessing deflation. This divergence could be partly attributed to differences in energy dependence, exchange rate volatility, and supply-side constraints.

Looking Ahead: Can Disinflation Be Sustained?

Although inflation appears to be easing across several economies, a key consideration is the sustainability of this downward trajectory. The potential for renewed supply chain disruptions coupled with the inflationary effects of the broad-based tariffs recently introduced by President Trump raises uncertainty. While the temporary 90-day suspension of these tariffs offers a short-term reprieve and may help stabilize market sentiment in the interim, any abrupt policy shifts or escalation in trade tensions could quickly reverse gains and trigger renewed volatility.

On the domestic front, the onset of the planting season in Q2 presents a seasonally upside risk to food inflation, as agricultural output typically contracts during this period. This combined with existing structural challenges in the food supply chain could moderate the pace of disinflation and possibly reverse the downward trend in the near term.