Democracy’s Dividends: How Inclusive Investing Strengthens Nigeria’s Democratic Fabric

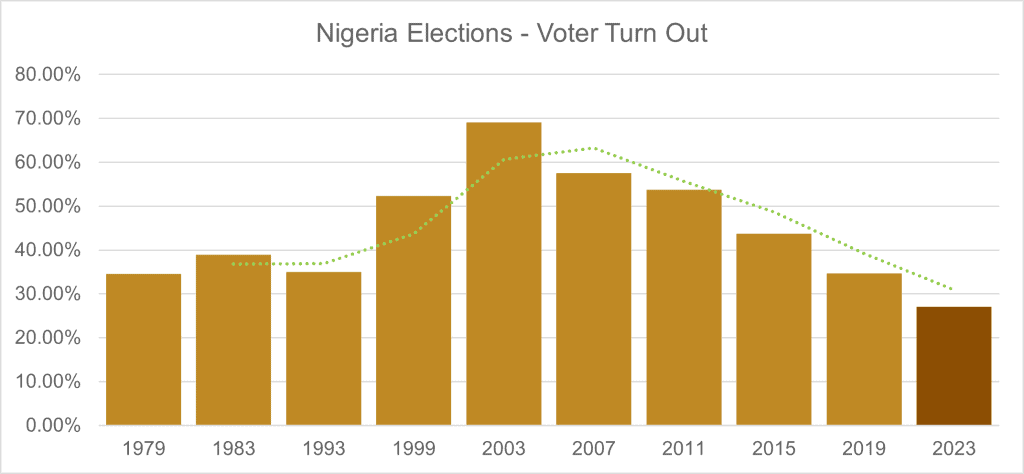

As Nigeria marks 26 years of uninterrupted democracy, we celebrate hard-won freedoms – yet confront a paradox. While electoral democracy endures, civic participation remains low. The 2023 presidential election recorded a historic low voter turnout of just 27%, despite a population nearly triple that of the early democratic era.

This democratic disengagement, interestingly, coincides with rising poverty (incidence up 22.6%, gap up 10.3%, severity doubled since 2010 [Source: Journal of Economics, Race &Policy]), which is enabled by several factors including persistent financial exclusion: 36% of Nigerian adults (39+ million people) remain entirely outside the formal financial system [EFinA A2F 2023]. This correlation is telling. In Sokoto, where 68% of adults lack formal financial access had a voter turnout of 28%. Contrast this with Ekiti – 86% formal inclusion and 32% voter turnout. This pattern suggests that, among a myriad of factors, financial exclusion erodes democracy’s foundations.

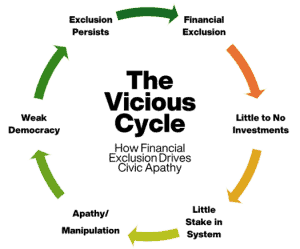

Research confirms that financially excluded Nigerians are three times more likely to sell their votes, transforming democracy into a transactional survival tactic. Denied access to wealth-building tools like stocks or bonds, millions see the wealth gap widen and inequality deepen. This increases vulnerability to vote-buying and unrest, reinforcing the damaging perception that “democracy serves only the rich,” and perpetuating a cycle of civic apathy. The Nigerians absent from ballot boxes are often the same ones absent from bank and investment ledgers – the solution for both lies in widespread economic stakeholding.

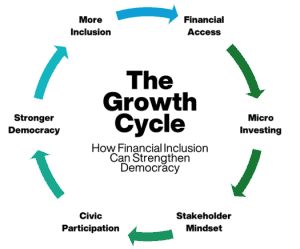

Nigeria’s $1 trillion economy ambition demands “investor-citizens” equipped to hold leaders accountable. When citizens become direct investors, they transform from passive observers into active stakeholders with a vested interest in national stability. This “skin in the game,” echoing Warren Buffett’s principle of aligned incentives, compels them to demand transparent governance and coherent policies to protect their assets. This fosters tangible economic resilience: nations with high retail investor participation consistently show lower GDP volatility during crises than those reliant on concentrated capital. Critically, economic self-reliance forged through investment cultivates the “independent middle-class citizen” essential for auditing leaders and stabilizing democracies. Mass investing transforms the Permanent Voter Card (PVC) into an economic bulwark: shareholders become natural guardians of national interests because their dividends depend on it. They actively monitor policies affecting markets, demand corporate accountability, and engage on economic governance.

The surge in mobile technology adoption offers a powerful pathway to digital financial inclusion. Platforms like i-Invest are pivotal, enabling micro-investments in Federal Government Savings Bonds, Treasury Bills, and corporate stocks/debt instruments. These apps are democratizing access, turning users into stakeholders with genuine “skin in the game,” empowering them to demand policy reforms and corporate accountability from a position of economic participation.

This Democracy Day, we must recognise that inclusive investing contributes significantly to democratic infrastructure. A Nigerian investment portfolio isn’t merely a wealth tool – it’s a stake in national stability. Imagine a Katsina farmer buying grain ETFs via simple USSD: his PVC evolves from a survival token into a share certificate in Nigeria’s future. Democracy isn’t just won at polling units – it’s built daily in bank accounts, nurtured in investment portfolios, and strengthened in vibrant markets. Investing in Nigeria means investing in the future of every citizen. To secure that future, we must bridge the gap; turn the excluded into investors, and investors into guardians.

This Democracy Day, take your stake in Nigeria’s future. Open an investment account. Become an investor-citizen. Claim your civic dividend: a stronger, more stable, and more accountable Nigeria.

Written By: Itoro Nehemiah