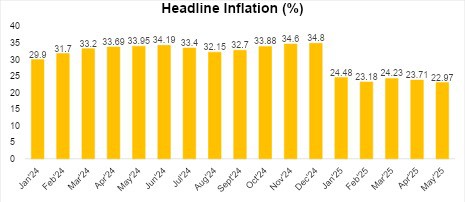

Inflation Slows Amid Stable FX, Declining Costs, and Weak Consumer Demand – May 2025

Nigeria’s headline inflation rate eased for the second consecutive month, falling to 22.97% in May from 23.71% in April, as price pressures moderated across both food and core segments of the Consumer Price Index (CPI). Food inflation dipped to 21.14% from 21.26% in April while core inflation fell to 22.28% from 23.39%. The month-on-month inflation rate also decelerated to 1.53% from 1.86% in April.

The moderation was largely underpinned by relative exchange rate stability, which helped ease imported inflation, alongside reduced logistics and operating costs stemming from lower PMS prices. These supply-side improvements coincided with weak consumer demand, as households continued to grapple with the erosion of real incomes. In the past year, the naira has appreciated by 6.39% at the official window and 9.20% in the parallel market, supported by the Central Bank’s reform-driven efforts to improve liquidity and transparency in the FX market.

Food Inflation Slows Despite Seasonal Pressures

Year-on-year food inflation edged lower to 21.14% in May, down slightly from 21.26% in April. This was partly supported by weaker consumer demand and lower costs of transporting produce from farm gates to market points. However, on a month-on-month basis, food inflation rose to 2.19% from 2.06% in April, reflecting seasonal supply constraints typically associated with the planting season.

Core Inflation Declines on FX Stability and Weaker Demand

Core inflation, which excludes volatile components such as food and energy, also declined to 22.28% year-on-year, from 23.39% in April. On a monthly basis, it slowed to 1.10%, down from 1.34%, pointing to reduced price pressures in non-food segments like transportation. The decline is largely explained by stable exchange rates, lower fuel and logistics costs, and waning demand for discretionary goods and services as consumers adjust to sustained real income compression.

Inflation Risks Persist Despite Disinflation Trend

While the recent disinflation trend is encouraging, several upside risks to the inflation outlook remain. In the global space, the impending expiration of Trump’s 90-day tariff suspension window in three weeks raises the risk of renewed trade tensions and global commodity price volatility, which could spill over into domestic inflation through higher import costs. Additionally, the recent rebound in global oil prices due to the escalating tensions in the Middle East may increase energy and transport costs if sustained.

On the domestic front, escalating insecurity in food-producing regions such as the recent killings in Benue and flooding in parts of Niger State could disrupt food supply chains, driving up staple prices.

Hence, while headline inflation appears to be on a moderating path, the balance of risks still tilts to the upside. Sustaining disinflation will require not only continued FX market stability but also targeted interventions to mitigate supply shocks, particularly in agriculture. For monetary authorities, the current environment calls for a cautious stance, balancing inflation management with support for a fragile recovery in domestic demand.