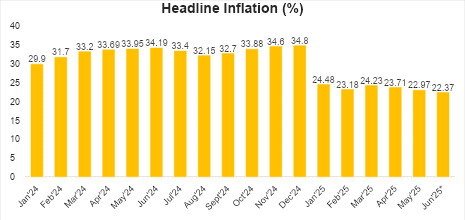

Inflation Forecast (June 2025): Further Decline to 22.37%

The National Bureau of Statistics (NBS) is scheduled to release Nigeria’s Consumer Price Index (CPI) and inflation data for June 2025 on July 15. Based on our model, headline inflation is projected to decline to 22.37% year-on-year, down from 22.97% recorded in May. If accurate, this would mark the third consecutive monthly decline in annual inflation, providing policymakers with a welcome window of relief at a time when ongoing fiscal and monetary reforms are gaining traction and helping to restore investor confidence.

The projected decline is primarily attributed to base effects, given the elevated price levels recorded during the same period last year. However, the downward trend in inflation is not purely a statistical phenomenon. The persistently weak consumer demand, driven by declining household purchasing power, continues to limit price transmission across many sectors, particularly in discretionary goods and services, where businesses face increasing resistance to price increases. Additionally, a relatively stable exchange rate and a moderation in domestic petrol prices have helped ease input cost pressures.

However, month-on-month inflation is projected to rise to 1.81% in June, up from 1.53% in May. The increase would be largely driven by a temporary spike in petrol prices in the month, following a rebound in global crude oil prices amid heightened geopolitical tensions between Israel and Iran. The brief uptick in energy prices had ripple effects on logistics and transportation costs, contributing to upward pressure on domestic price levels.

Outlook: Inflation is Likely to Continue its Downward Trend in the Near Term

Looking ahead, we expect the downward inflation trend to persist over the coming months, supported by a combination of seasonal tailwinds, global policy developments, and ongoing domestic reforms.

One of the most important domestic drivers will be the commencement of the harvest season in Q3. This is expected to improve food supply and moderate food inflation, which remains a major component of Nigeria’s inflation basket. In addition, improved investor sentiment toward Nigeria’s reform trajectory continues to support capital inflows. These inflows will not only bolster external reserves but also provide currency support, thereby helping to contain imported inflation.

On the global front, the extension of the U.S. tariff suspension deadline by President Trump from July 9 to August 1 also provides temporary relief to global trade and commodity markets. This move has lowered the near-term risk of trade disruptions, easing concerns about input cost inflation and global supply bottlenecks. For Nigeria, which remains highly import-dependent, this reduces the risk of pass-through effects from higher landed costs on key imports.

However, risks remain on the horizon. Volatility in global energy prices, insecurity in food-producing regions, and structural bottlenecks in supply chains all continue to pose threats to the disinflation path.