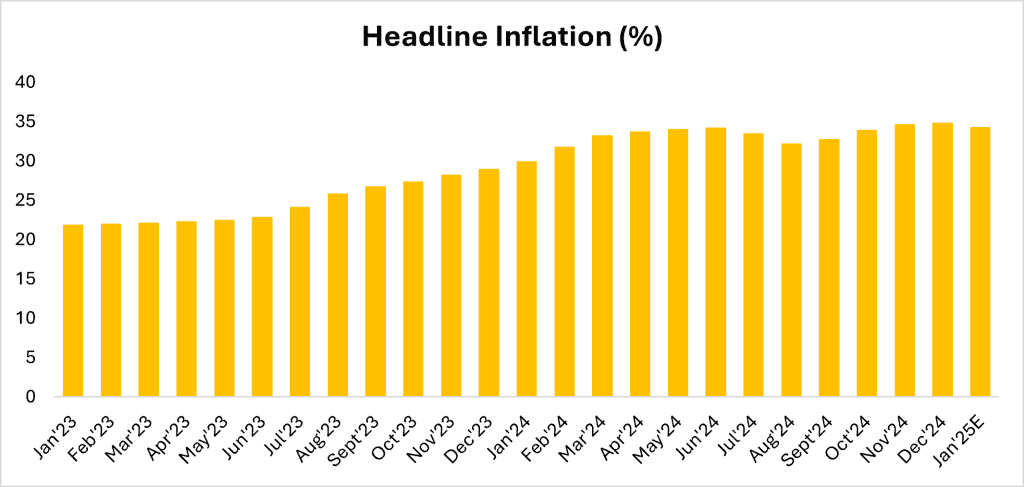

Nigeria’s Inflation Expected to Drop to 34.2% in January 2025

Earlier this year, the National Bureau of Statistics (NBS) announced its plans to rebase both the Consumer Price Index (CPI) and Gross Domestic Product (GDP), sparking significant discussions about the potential impacts of these adjustments. As the NBS prepares to release its January 2025 CPI and inflation data next week, all eyes are on how the rebasing will affect inflation measurement. Although the new methodology will offer a more updated view of economic trends, our projections based on the old methodology suggest that headline inflation could decline slightly to 34.2% in January 2025, down from 34.8% in December 2024. The month-on-month inflation sub-index is also expected to drop to 2.18%, down from 2.44% in December 2024. This moderation in price pressures is expected to be primarily driven by improvements in both the food and non-food sub-indices.

Food inflation is projected to decline as commodity supply increases

Based on our model, food inflation is projected to decline on both an annual and monthly basis. Year-on-year, the food sub-index is forecasted to fall to 38.55% in January 2025, down from 39.84% in December 2024. The month-on-month food sub-index is expected to drop to 2.26%, down from 2.87% in December 2024. This deceleration is attributed to the harvest season for commodities such as tomatoes, onions, and beans, leading to a sharp reduction in their prices. For instance, the price of a basket of tomatoes dropped to as low as N11,000 in January. While supply has increased, demand has remained relatively subdued due to higher financial obligations at the start of the year, particularly for tuition fee payments. Additionally, the Naira appreciation has helped ease imported food inflation, with the Naira gaining 1.86% (official market) in January 2025 as the Central Bank of Nigeria (CBN) strengthens efforts to improve transparency and boost investor confidence.

Core inflation is estimated to decline on Naira stability

Similarly, the core inflation sub-index, which excludes food and energy, is expected to decrease on both an annual and monthly basis. On an annual basis, core inflation is projected to fall to 28.82%, down from 29.28% in December 2024, while monthly, it is estimated to decline to 1.88%, down from 2.24% in December 2024. This slowdown in core inflation is expected to be supported by a stronger Naira and lower logistics costs.

MPC to hold its fire at the February meeting

The Monetary Policy Committee (MPC) is set to hold its first meeting of the year on February 19-20, 2025. Given the expected moderation in inflation and the stability of the Naira, the MPC is likely to take a cautious approach, opting to observe evolving economic conditions before making any significant adjustments. This decision is aimed at supporting economic stability while keeping inflationary pressures in check, especially as the effects of the rebased CPI methodology become clearer. The committee is also likely to proceed with caution, considering the potential inflationary effects of tariff imposition under President Donald Trump’s administration.