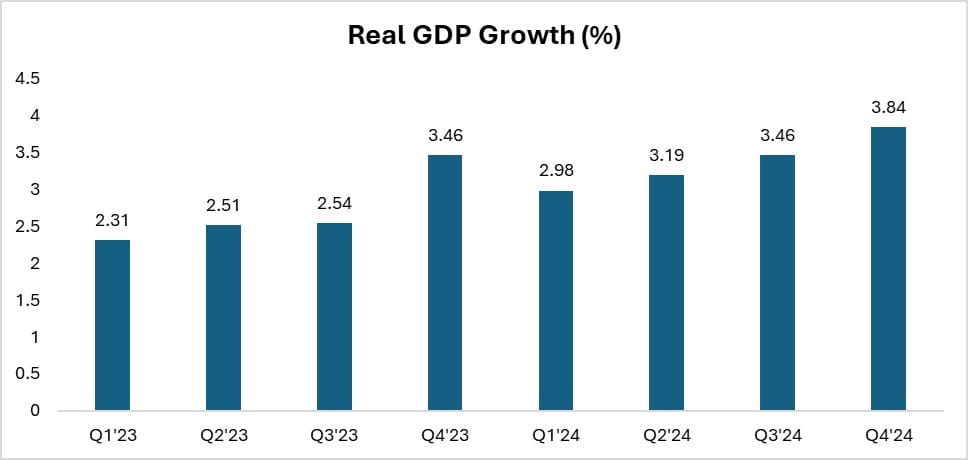

Nigerian Economy Maintains Strong Growth Momentum in Q4 2024

The Nigerian economy sustained its growth momentum in the fourth quarter of 2024, expanding by 3.84%. This marks an improvement from the 3.46% growth recorded in Q3 2024 and Q4 2023. As a result, Nigeria’s GDP growth for 2024 stands at 3.4%, a notable rise from 2.74% in 2023. This continued positive trajectory signals the Nigerian economy’s resilience and ability to sustain growth amidst external and internal challenges.

The growth in Q4 2024 was primarily driven by a surge in aggregate demand, which typically spikes during the festive period. Furthermore, agricultural output benefitted from the harvest season, contributing significantly to economic growth. The agricultural sector grew by 1.76% in Q4 2024, compared to 1.14% in Q3 2024, primarily driven by improved performance in crop production.

The reduction in Premium Motor Spirit (PMS) prices also played a significant role in driving economic growth. A decline in Brent crude prices and the commencement of operations at the Dangote refinery, along with other refineries like Old PH and Warri, helped lower transportation and operational costs for both consumers and businesses.

25 activities expanded, 15 slowed and 6 contracted

The fourth quarter of 2024 also saw continued progress in Nigeria’s major sectors. Notably, 25 activities expanded, 15 slowed, and 6 contracted, indicating positive economic developments. This marks an improvement compared to the third quarter of 2024, when more sectors contracted (22 Expanded, 14 Slowed and 10 Contracted). The Central Bank’s efforts to stabilize the Naira appear to be paying off, particularly in the real sector, with evidence suggesting that the Nigerian economy is more sensitive to exchange rates than interest rates. Moreover, the decline in PMS prices is having a noticeable effect on the transportation sector, which grew by 18.61%, a significant jump from the 12.15% growth seen in Q3 2024.

Below is a breakdown of key sectors/activities that expanded, slowed or contracted.

Expanding sectors/Activities | Q3’24 | Q4’24 | Comments |

Agriculture | 1.14 | 1.76 |

|

Manufacturing | 0.921 | 1.79 |

|

Trade | 0.65 | 1.19 |

|

Construction | 2.91 | 2.95 |

|

Real estate | 0.68 | 0.86 |

|

Transport and Storage | 12.15 | 18.61 |

|

Slowing & Contracting Sectors/Activities | Q3’24 | Q4’24 | Comments |

Crude petroleum and natural gas | 5.171 | 1.48 |

|

Financial and Insurance | 30.83 | 27.78 |

|

Electricity supply | 3.23 | -5.04 |

|

Coal mining | -63.56 | -121.33 |

|

GDP Outlook

Looking ahead, Nigeria’s GDP growth outlook appears cautiously optimistic, with several factors that could foster a favorable economic environment. As inflation continues to moderate, there is a strong possibility that the Central Bank of Nigeria (CBN) may opt for a shift towards monetary easing in the second half of the year. This would likely result in lower interest rates, which in turn would reduce financing costs for businesses, encouraging expansion and investment. A more favorable monetary policy environment would make credit more accessible and affordable, which could fuel growth in both the corporate and SME sectors.

Additionally, the implementation of a new minimum wage policy is expected to positively impact consumer purchasing power. As wages rise, the disposable income of workers will increase, which is expected to stimulate domestic demand. This, in turn, will likely have a positive effect on retail consumption, as well as boost business revenues across various sectors. With the ongoing disinflation process, the combination of higher wages and more stable prices will help to restore confidence in the economy and foster a more vibrant consumer market.

However, while these developments paint an optimistic picture, there are still potential risks that could derail the economic outlook. One significant risk is the ongoing global trade uncertainties, particularly the potential for tariffs and restrictive trade policies from major global economies. For example, any shifts in the trade policies of the United States, under President Donald Trump or subsequent administrations, could have significant ripple effects on Nigeria’s economy. Tariffs and import restrictions could hinder the growth of Nigeria’s export sectors, such as oil and agricultural products, while also increasing the cost of imported goods.

Furthermore, the potential tightening of immigration policies in key economies could impact the remittance flows to Nigeria. Remittances from Nigerians working abroad are a critical source of foreign exchange and a key contributor to household income for many families in Nigeria. Any restrictions on immigration or changes to work visa policies in countries like the United States could reduce the number of Nigerians able to send money back home, negatively affecting domestic consumption and economic stability.