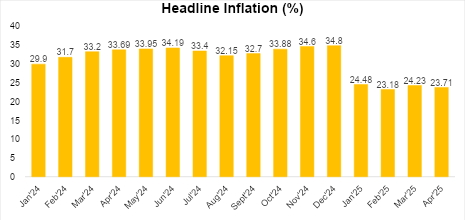

Headline Inflation Eases to 23.71% Amid Broad-Based Price Deceleration

The April 2025 Consumer Price Index report published by the National Bureau of Statistics indicated a broad-based slowdown in price increases. Invariably, headline inflation declined by 0.52% to 23.71%, down from 24.23% in March. This contrasts with our projection of an upturn to 25.05%. Although our estimate for food inflation closely aligned with the official data, our forecast of a rise in core inflation to 25.84% diverged from the NBS figure, which showed a decline to 23.39%. We had expected continued upward pressure from exchange rate pass-through effects. However, the lower-than-expected core inflation suggests that the impact of currency depreciation may have been muted or offset by subdued consumer demand and heightened resistance to price increases.

Food inflation Eased despite the onset of the planting season

In April, food inflation moderated on both an annual and monthly basis. The year-on-year food inflation rate declined by 0.53% to 21.26%, while the monthly food index dropped by 0.12% to 2.06%. This slowdown occurred despite the onset of the planting season; a period typically marked by supply constraints.

One of the key drivers behind the decline was the drop in the price of rice following India’s removal of export duties, which increased global supply and reduced import costs. Additionally, seasonal availability of maize supported domestic food supply, further tempering upward pressure on prices.

Nonetheless, rising prices of non-food essentials, particularly energy costs such as electricity continue to strain household budgets. This is reducing the share of income available for food, prompting consumers to become more cautious and resistant to price increases, which in turn has helped curb food inflation.

Inflation Expectations and Possible Policy Response

Inflation is likely to increase in the coming months due to the planting season effect and a gradual pickup in petrol imports, which could increase FX demand and weigh on the Naira. However, the temporary suspension of tariffs between the U.S. and China is expected to dampen global inflationary pressures and reduce imported inflation risks.

The Monetary Policy Committee (MPC) is scheduled to meet next week (May 19/20) to assess recent economic developments. In our view, the committee is likely to maintain the current policy stance, keeping all monetary parameters unchanged while closely monitoring inflation dynamics and exchange rate developments.