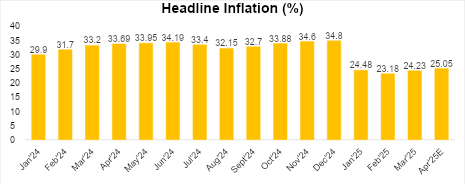

Headline Inflation Forecasted to Rise Again (In April) as Core Pressures Persist

The National Bureau of Statistics is expected to release the April 2025 Consumer Price Index (CPI) and inflation report later today. Based on our econometric model, headline inflation is projected to climb further to 25.05%, up from 24.23% in March. If accurate, this would mark the second consecutive monthly increase. The projected acceleration would be primarily driven by core inflation, which is estimated to increase to 25.84% from 24.43% in March. This uptick underscores ongoing structural pressures in the economy, suggesting that inflationary pressures remain deeply embedded.

Nonetheless, there are signs of easing pressures on a monthly basis. The relative stability in the exchange rate in April, alongside a modest decline in petrol prices, attributable to a reduction in the ex-depot price from the Dangote refinery and weaker global crude oil prices following tariff measures by President Donald Trump is expected to support a deceleration in month-on-month core inflation to 3.36% in April from 3.72% in March

Food Inflation to Ease as India Lifts Rice Export Duties and Weak Demand Persists

Food inflation is forecast to ease slightly on a year-on-year basis, with our model projecting a decline to 21.4% in April from 21.79% in March. On a monthly basis, food prices are expected to remain relatively flat at 2.17%. During the month, we observed a mixed movement in commodity prices. While the price of perishables like tomatoes and pepper increased due to the impact of the planting season on supply, the price of rice declined significantly, largely due to India’s removal of export duties on rice.

Inflation Outlook and Monetary Policy Expectations

Inflationary pressures are likely to persist in the coming months due to the planting season effect and a gradual pickup in petrol imports, which could increase FX demand and weigh on the Naira. However, the temporary suspension of tariffs between the U.S. and China is expected to dampen global inflationary pressures and reduce imported inflation risks.

The Monetary Policy Committee (MPC) is scheduled to meet next week (May 19/20) to assess recent economic developments. In our view, the committee is likely to maintain the current policy stance, keeping all monetary parameters unchanged while closely monitoring inflation dynamics and exchange rate developments.