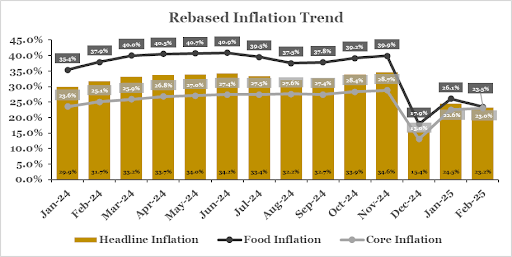

Nigeria's Headline inflation slows to 23.18% in February

The Consumer Price Index (CPI) and inflation data for February, released yesterday, revealed a notable moderation in headline inflation, which decreased to 23.18%, down from 24.48% in January. This deceleration was primarily driven by a significant reduction in food inflation. According to the National Bureau of Statistics (NBS), food inflation fell by 2.57%, dropping to 23.51% in February from 26.08% in January. This decline was largely anticipated, given the seasonal effects of the harvest period and a reduction in logistics costs, which benefited from the pass-through impact of lower energy prices during the month. Additionally, the relative stability of the exchange rate in February helped ease inflationary pressures on imported food items, even as consumption demand remained subdued due to broader economic challenges.

In contrast, core inflation, which excludes volatile food and energy components, showed a slight increase, rising to 23.01% from 22.60% in January. The uptick in core inflation highlights that underlying inflationary pressures persist, indicating that inflation risks remain embedded in the economy. This suggests that while the decline in food inflation provides some temporary relief, inflationary expectations continue to be driven by structural factors, including supply chain constraints and persistent cost pressures in non-food sectors. Policymakers will continue to monitor these trends closely, as they weigh the implications for monetary policy and broader economic stability.

Is the Downward Trend in Inflation Sustainable in the Coming Months?

The inflationary trajectory in the coming months will be influenced by multiple factors. The anticipated increase in demand due to the Ramadan and Easter festivities is likely to temporarily boost consumer spending, particularly in the food and transportation sectors. Furthermore, the recent suspension of the Naira-for-crude arrangement between Dangote Refinery and the NNPCL, if not reinstated, may lead to significant currency pressures as the refinery would need to source foreign exchange to procure crude oil. Additionally, the onset of the planting season in the second quarter is expected to reduce the supply of certain commodities, potentially pushing prices higher.

We expect the monetary authorities to closely monitor these developments and the evolving inflation data, as they will play a crucial role in shaping policy decisions at the next meeting in May.