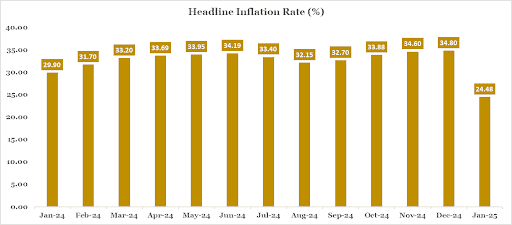

Nigeria’s Inflation Expected to Decline to 32.7% in February 2025

Inflation continues to dominate economic discussions in Nigeria, especially after the surprisingly low figure reported in January (24.48%), which was largely influenced by the rebasing exercise by the National Bureau of Statistics (NBS). As the debate surrounding Nigeria’s true inflation rate intensifies, we expect a decline in February 2025 inflation rate to 32.78% year-on-year, based on the old methodology. This forecast is underpinned by a steady decline in both food and non-food prices, largely due to the strengthening of the Naira and a reduction in logistics costs. Notably, the Naira was relatively stable at the official exchange rate market, while it recorded an appreciation of 8.00% to close at N1,490.00 in the parallel market in February. Additionally, the reduction in the pump price of Premium Motor Spirit (PMS) in February, following a cut in the ex-depot price by Dangote Refinery from N890/litre to N825/litre, also contributed to this expected decline.

Food Inflation to Ease Amid Lower Logistics Costs

Food inflation is expected to decrease both on an annual and monthly basis in February. Year-on-year, the food sub-index is expected to fall to 36.21%. This reduction is largely attributed to lower logistics costs, driven by the decrease in energy prices during the month. Furthermore, weakened consumer purchasing power, which has led to reduced spending, combined with the stability in the prices of imported food products, supported by Naira appreciation, are factors supporting this projection. While the FAO Food Price Index (FFPI) rose to 127.1 points in February, an increase of 2.0 points from January, largely due to higher prices for sugar, dairy, and vegetable oils, we expect the impact of this to be tempered by the strengthening of the Naira.

Core Inflation

In line with the food sub-index, core inflation (which excludes food and energy) is also projected to decrease both annually and monthly. On a year-on-year basis, core inflation is expected to slow to 27.97%. This anticipated decline is driven by the appreciation of the Naira and the easing of supply chain disruptions.