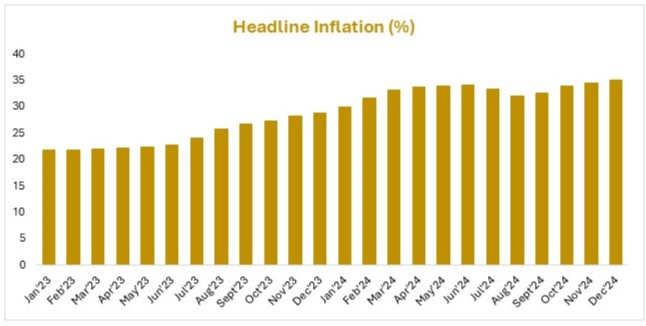

Nigeria’s Headline Inflation to climb 35.01% in December 2024

The National Bureau of Statistics (NBS) is scheduled to release the Consumer Price Index (CPI) and inflation data for December 2024 on Wednesday, January 15, 2025. At Parthian Partners, we expect a continued increase in headline inflation, projecting it to rise to 35.01%, up from 34.6% in November 2024. This would mark the fourth consecutive monthly increase and the highest rate in 28 years. The persistent rise in headline inflation is expected to be largely driven by food prices, with food inflation estimated to increase by 0.25% to 40.18%.

However, there are signs of a slowdown: the rate of inflation growth appears to be easing. We also forecast a slight reduction in core inflation, predicting it will drop to 28.61% from 28.75% in the previous month. Moreover, all monthly inflation sub-indices are expected to show a decline. The overall month-on-month inflation rate, which more accurately reflects recent price changes, is projected to ease to 2.60% (annualized at 36.02%), down from 2.64% (annualized at 36.69%) in November. Food inflation is expected to decrease to 2.91%, while core inflation is predicted to fall to 1.72%, compared to 2.98% and 1.83% respectively in November.

These developments suggest that inflation may be approaching a turning point. The expected deceleration in inflation growth can be partly attributed to the recent appreciation of the exchange rate and the reduction in the price of Premium Motor Spirit (PMS). However, the full impact of these factors is expected to become more apparent in January 2025. Following the introduction of the Electronic Forex Matching System and a boost in dollar inflows from visiting friends and families, the Naira appreciated in December, gaining 8.74% to close the month at N1,538.25/$ at the official window.

NBS to rebase GDP and CPI.

The National Bureau of Statistics (NBS) has revealed plans to rebase Nigeria’s Consumer Price Index (CPI) and Gross Domestic Product (GDP) to more accurately reflect the country’s current economic conditions. The base year for the CPI will be updated to 2024, an important adjustment considering that the last rebase occurred in 2009. Ideally, a nation’s CPI should undergo rebasing every five years to better capture shifts in consumer behavior and broader economic trends.

However, since the last rebase was over a decade ago, this decision to revise the base year has become increasingly urgent. Over the past years, Nigeria’s economy has faced a range of significant disruptions, such as the COVID-19 pandemic, the liberalization of the foreign exchange (FX) market, and the removal of the subsidy on Premium Motor Spirit (PMS). These events have reshaped how Nigerians spend their money, altering consumption patterns in profound ways. Given these major changes, updating the CPI will help the NBS effectively track the evolving expenditure habits of Nigerian households.

In recent years, consumer preferences in Nigeria have undergone significant shifts, with increased spending directed toward services such as healthcare, communication, and transportation. Conversely, expenditure on traditional goods like food and beverages has been influenced by both rising prices and evolving consumption habits. These dynamics underscore the urgent need to update the price and weight references used in the Consumer Price Index (CPI) calculation. By incorporating these changes, the rebasing process seeks to deliver more precise inflation measurements that accurately reflect the realities of Nigeria’s modern economy. Such improvements are vital for shaping effective monetary and fiscal policies.

While the potential benefits of a rebased CPI are clear, concerns remain regarding the methodology, particularly the selection of new price and weight references. A critical aspect of this process is choosing a base year that adequately captures the structural transformations within the economy over time. Without a carefully considered approach, the rebasing risks overlooking or underrepresenting key drivers of inflation. This could lead to inaccuracies in data, ultimately impairing policy formulation and economic planning.

To ensure the success of this effort, the rebased CPI must align with the current spending patterns of Nigerian households, reflecting the significant changes that have reshaped the economy in recent years. When executed correctly, the rebasing will not only enhance the accuracy and reliability of inflation data but will also provide a robust foundation for informed decision-making. The ripple effects of this improvement will extend to better monetary policy, more targeted fiscal strategies, and greater economic stability, making it an essential step in Nigeria’s economic development journey.