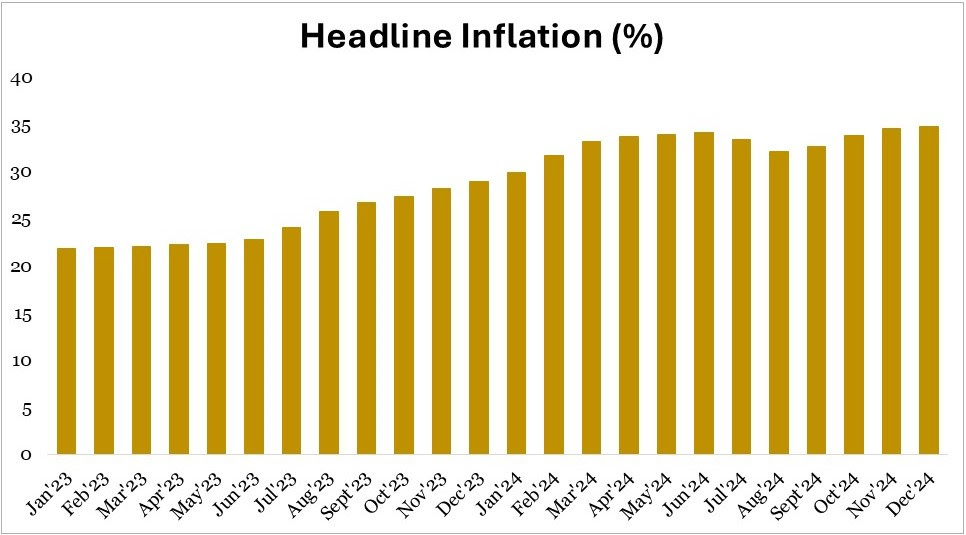

Nigeria’s Inflation Rises to 34.80% in December 2024

The National Bureau of Statistics (NBS) recently released the Consumer Price Index (CPI) and inflation data for December, which highlighted continued inflationary pressures within the Nigerian economy. As anticipated, headline inflation rose further to 34.80% in December, up from 34.60% in November. This marks the fourth consecutive monthly increase and the highest level in almost three decades.

The primary driver behind this persistent inflation is core inflation, which increased by 0.53% to 29.28%. Core inflation, which excludes volatile items like food and energy, typically reflects more structural issues within the economy, indicating that these underlying pressures are still prevalent despite efforts to curb them. On the other hand, food inflation, which has been one of the most significant contributors to the overall inflation rate, experienced a slight decline of 0.09%, reaching 39.84% despite the festive period. This is the first time in four months that food inflation has shown any decline. The decrease can be attributed to consumer price resistance due to income constraints, with a particularly notable drop in the prices of perishable goods, such as tomatoes, which saw a sharp fall in prices.

Is the inflation trend likely to reverse soon?

Despite the continued rise in headline inflation, the pace of the increase is showing signs of moderation. In December, the rate of inflation rose by just 0.2%, a significant slowdown compared to the 0.72% increase recorded in November. This deceleration suggests that while prices are still climbing, the intensity of these increases is diminishing.

Further, month-on-month inflation, which provides a snapshot of recent price movements, declined by 0.2% to 2.44%, indicating a short-term easing in price growth. This trend could signal that inflation is approaching a potential turning point, offering some relief to households and businesses.

However, the persistent rise in core inflation, which excludes volatile items like food and energy, highlights deeper structural issues in the economy. These underlying challenges, including supply chain inefficiencies, exchange rate volatility, and high production costs, could sustain elevated inflation levels over the longer term if not effectively addressed.

Policymakers must leverage this moment of slowing inflationary momentum to implement strategic reforms aimed at tackling these structural constraints and fostering sustainable economic stability.

Will the CPI rebasing contribute to a decline in inflation?

The National Bureau of Statistics (NBS) is set to release its rebased inflation figures by the end of January, sparking widespread debate about whether the rebasing could push inflation into single digits. While a significant drop to single-digit inflation remains unlikely, the rebasing process may lead to a slight reduction in reported inflation.

This potential decrease is largely because adopting 2024 as the new base year could partially dilute the effects of the elevated inflationary pressures experienced throughout 2024. These pressures were driven by critical economic reforms, such as the removal of the PMS subsidy and the liberalization of the foreign exchange market, both of which had a profound impact on prices.

Despite the anticipated challenges, the rebasing exercise is long overdue and is essential for improving the accuracy and relevance of Nigeria’s inflation measurement. By aligning the Consumer Price Index (CPI) with current economic realities and spending patterns, the rebasing will provide a more precise tool for monitoring inflation and guiding monetary and fiscal policy decisions.

How will inflation data impact the upcoming MPC meeting?

The Monetary Policy Committee (MPC) is set to convene its first meeting of 2025 on February 17 and 18, with inflation remaining a pivotal factor shaping its deliberations and decisions. While the recent slowdown in the pace of headline inflation and the decline in month-on-month inflation offer some reassurance, these trends are unlikely to prompt immediate changes in monetary policy.

Given the still-elevated inflationary environment, the MPC is expected to maintain its current stance, prioritizing stability while closely monitoring inflation dynamics in the coming months. Policymakers will likely assess additional data to determine whether the recent moderation represents a sustained trend or a temporary fluctuation.

The committee’s cautious approach underscores the importance of balancing inflation control with supporting economic growth, ensuring that any future adjustments are data-driven and aligned with broader economic objectives.