Nigeria’s January Inflation at 24.48%: Impact on Policy Decisions

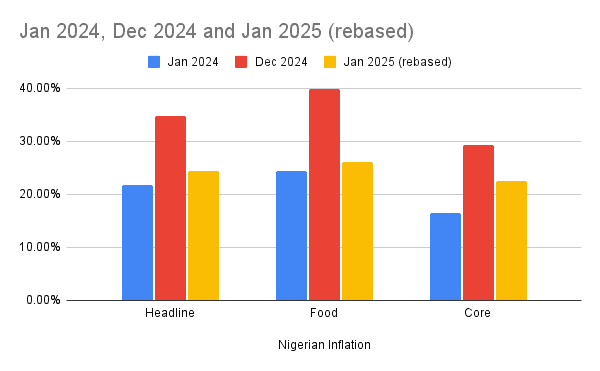

The National Bureau of Statistics (NBS) has released the rebased Consumer Price Index (CPI) for January 2025, marking a major shift from the old methodology that was previously used. The last CPI rebasing in Nigeria took place in 2009, which is over a decade ago, while the global standard recommends a revision every five years. CPI rebasing involves updating the price and weight reference periods to better reflect current economic realities, providing a more accurate picture of inflation trends. According to the rebased CPI, Nigeria’s headline inflation for January 2025 is recorded at 24.48%, while the food and core inflation rates stand at 26.08% and 22.59%, respectively.

Rebased CPI and Common Misconceptions

There has been some confusion surrounding the January 2025 inflation figure, with many interpreting the 24.48% rate as a sharp decline from the 34.8% recorded in December 2024. However, comparing these figures directly is misleading, as they are based on two different methodologies. The December 2024 inflation figure is calculated using the old approach, while the January 2025 figure is based on the newly adopted rebased CPI, which includes updated price and weight reference periods. The two figures should not be compared directly as they reflect different data sets.

A more accurate way to assess inflation trends is to focus on the newly rebased CPI, which will provide a more realistic reflection of the economy going forward. In addition, it is crucial to observe the longer-term inflation patterns to get a clearer understanding of the inflation trajectory in Nigeria.

Key Changes in the Rebased CPI

Upon reviewing the rebased CPI report, several key changes and updates can be observed:

- Price Reference Period: The price reference period for the rebased CPI is now 2024, compared to 2009 under the old methodology.

- Weight Reference Period: The weight reference period was derived from the 2023 Nigerian Living Standards Survey and the 2024 Survey of Rare Items.

- Number of Products in the Basket: The number of items included in the CPI basket has increased from 740 products under the old methodology to 934 products in the rebased CPI.

- Classification System: The new methodology uses the 2018 version of the Classification of Individual Consumption by Purpose (COICOP), which is more updated and reflective of current consumption patterns, compared to the 1999 version used previously.

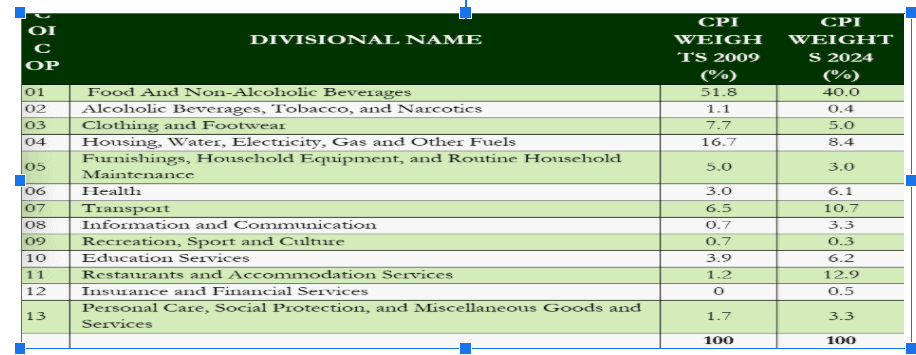

Changes in Weights

One of the most significant changes in the rebased CPI is the adjustment of weights, particularly for food. The weight for food was reviewed downwards, reflecting the exclusion of meals eaten outside the home. This now falls under the category of restaurants and accommodation.

Additionally, there have been increases in weights for categories such as education, health, information & communications, and transport. The rising cost of education and the growing importance of transportation, particularly due to the recent spike in the price of Premium Motor Spirit (PMS), have led to these adjustments. As these categories become more price inelastic, higher weights reflect their increasing significance in household budgets.

Impact on Policy Decisions

The Monetary Policy Committee (MPC) will be concluding its two-day meeting today. We expect the committee to leave all monetary policy parameters unchanged, given that one month of inflation data is insufficient to make significant policy adjustments. The MPC will likely wait for additional data before considering more substantial changes to the monetary policy stance. This cautious approach is important as the CBN assesses the full impact of the recent inflationary trends and economic developments.