Oil Market Turmoil: How Trump’s Tariffs and OPEC’s Oversupply Are Undermining Nigeria’s Economic Hopes

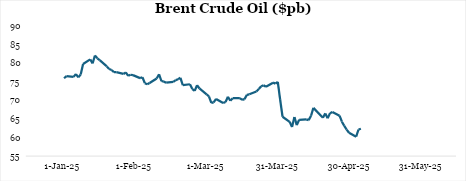

The global oil market in 2025 has dealt a heavy blow to oil-dependent economies and Nigeria is feeling the brunt of it. Crude oil prices, which started the year on a bullish note, exceeding $82 per barrel in mid-January, have since plunged by almost 25%, falling to $62.35 per barrel as of May 7.

For Nigeria, this sharp decline has created a fiscal quagmire. The 2025 budget was anchored on an oil price benchmark of $75 per barrel, and the current price reality introduces a major shortfall in anticipated revenues. This mismatch is not just a budgeting error, it threatens the government’s ability to fund essential services, infrastructure projects, and social programs, putting public finances under acute strain.

A Domestic Oil Sector Still Underperforming

According to OPEC monthly report, Nigeria’s oil production has remained above 1.5mbpd (OPEC quota) since January 2025, although it declined slightly to 1.52mbpd in March from 1.54mbpd in February. However, while Nigeria’s current oil production hovers slightly above its OPEC+ quota, it remains significantly below the 2025 budget’s benchmark of 2.06mbpd. This discrepancy poses a serious challenge to revenue generation. Even with marginal gains in output, the gap between actual production levels and budget expectations means Nigeria is falling short on both price and volume, a double setback for an economy heavily reliant on oil inflows.

Compounding the issue are long-standing structural problems in the oil sector, including rampant crude theft, pipeline vandalism, underinvestment, and aging infrastructure. These challenges continue to undermine production capacity and limit the country’s ability to take advantage of any potential price recovery in the global market.

Given that oil dominates Nigeria’s export earnings, foreign exchange inflows, and public sector funding, this crisis signals more than a temporary downturn. The dual impact of falling prices and dwindling production threatens the stability of the naira (N1,608.10/$ as of May 7), the strength of external reserves ($38.1 bn as of May 6), and the broader health of the economy. In addition, inflationary pressures (24.23% in March) and rising debt obligations loom large on the horizon.

The Global Double Whammy: Trade Wars and Supply Surges

Two major global events have triggered the current oil market turmoil: renewed trade protectionism led by the United States, and a poorly timed production surge from OPEC+.

Tensions escalated dramatically after President Donald Trump introduced sweeping tariffs on April 2. This included a minimum 10% tariff on imports from all countries, with even steeper duties targeting trade surplus nations. China swiftly retaliated, sparking a tit-for-tat escalation that ultimately saw U.S. tariffs on Chinese goods climb to 145%, and China’s response reaching 125%. The disruption to global trade flows triggered a sharp drop in oil demand expectations, driving prices down to $60 per barrel, the lowest level in nearly five years.

In an unfortunate twist, just as global demand was contracting, OPEC+ opted to increase output. The cartel has agreed to accelerate oil production, adding 411,000 barrels per day in June. This brings the total output hike across April, May, and June to 960,000 bpd, effectively reversing 44% of the 2.2 million bpd in cuts implemented since 2022, according to Reuters. However, this move proved ill-timed. Instead of boosting market confidence, the increased supply stoked fears of an oversaturated market. Oil prices, which had held above $74 as of April 2, slipped steadily over the following weeks, reaching $60.23 by May 5, a level not seen since mid-2023.

What Next for Nigeria?

If oil prices remain depressed, Nigeria will be forced to make difficult economic decisions. The government may need to revise its budget assumptions, increase borrowing, or implement spending cuts, all of which come with serious economic and political trade-offs.

The current crisis highlights a harsh reality: the era of predictable oil windfalls is over. Global market volatility, geopolitical risks, and the accelerating global shift toward renewable energy are reshaping the landscape. For Nigeria, survival and prosperity will require more than hope for a rebound.

The path forward must involve disciplined fiscal management, accelerated economic diversification, and a redefined role for oil in national development strategy. The current shock should not just be seen as a crisis, but as a crucial turning point.

4. Why These Practices Matter

- Prevent Identity Theft: Protect your personal and financial information.

- Maintain Privacy: Keep your online activities and data confidential.

- Secure Your Accounts: Prevent unauthorized access to your email, social media, banking, and other accounts.

- Avoid Financial Loss: Safeguard your money and prevent fraud.

- Protect Your Reputation: Prevent others from using your accounts to spread misinformation or harm your image.

By following these healthy password practices, you can significantly enhance your online security and protect yourself from cyber threats.