Parthian Partners Urges Pension and Insurance Industry to Invest More in Capital Markets for a Stronger Economy

The Chief Finance Officer (CFO) of Parthian Partners, Mr. Olayinka Arewa, expressed optimism about the success of the ongoing banking recapitalisation exercise. Speaking at the Finance Correspondents Association of Nigeria (FICAN) annual workshop in Lagos, themed ‘Nigeria’s Journey Towards a $1 Trillion Economy: Impact of Banks’ Recapitalisation, Opportunities for Fintechs, and the Real Sector’, Arewa drew parallels between the current recapitalisation and the successful exercise of 2004.

Under the new Central Bank of Nigeria (CBN) requirements, international banks must raise their capital base to ₦500 billion, national banks to ₦200 billion, and regional banks to ₦50 billion. The goal is to build stronger, more resilient banks that will play a key role in driving development across all sectors and support the vision of a $1 trillion economy by 2030.

Reflecting on the 2004 recapitalisation, Arewa noted that Nigeria had 89 banks with a fragmented structure and a minimum capital base of ₦2 billion, roughly $250 million at the time. Despite uncertainties, the industry successfully navigated the changes, resulting in stronger institutions capable of surviving economic shocks.

“Today’s recapitalisation exercise is similarly poised for success,” Arewa said. “With advancements in technology and changing consumer demands, banks are now operating in spaces unimaginable in 2004. Back then, the recapitalisation led to a boom in retail banking. Today, we have a more sophisticated and tiered banking system, along with fintechs and microfinance institutions, ready to absorb this shift.”

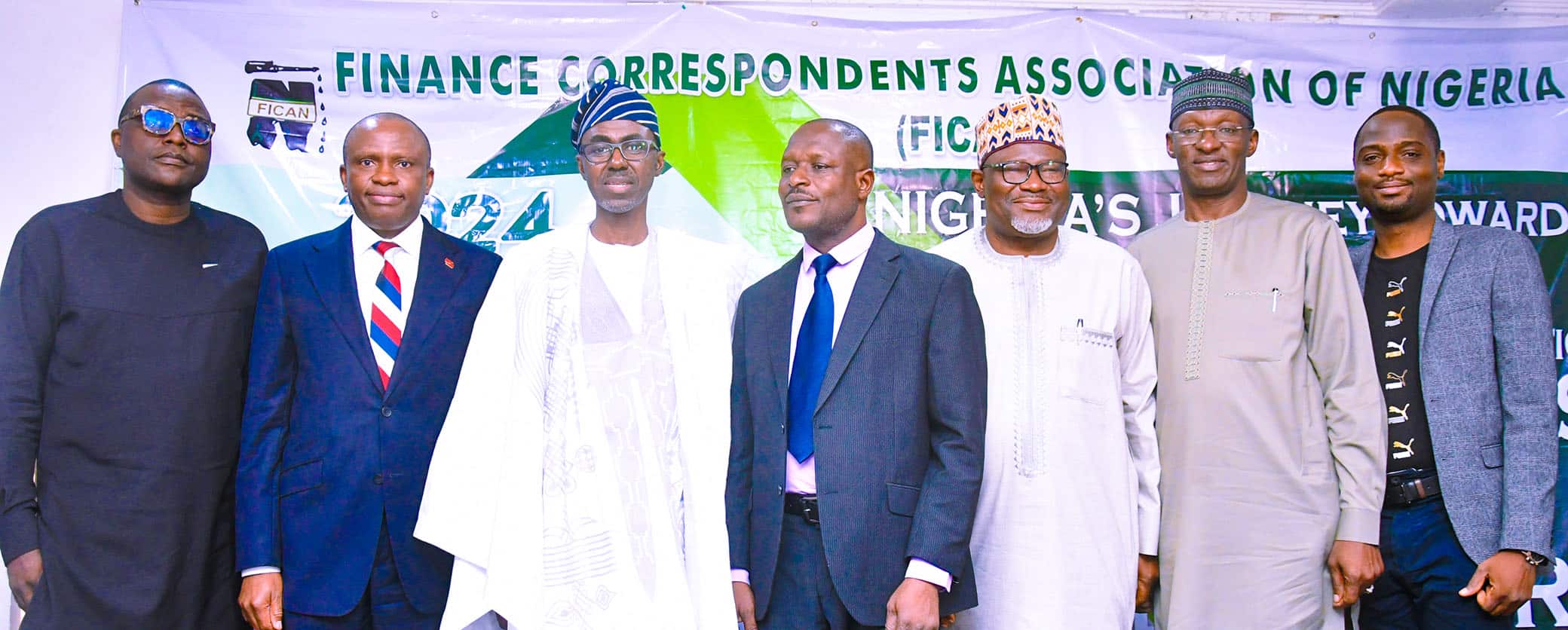

From left: Head of Strategy and Research, Nigeria Inter-Bank Settlement Systems (NIBSS) Plc, William Uko; Executive Director of Finance and Risk Management, UBA, Ugochukwu Nwaghodoh; MD/CEO of Nigeria Deposit Insurance Corporation (NDIC), Hassan Bello; Chairman of the Finance Correspondents Association of Nigeria (FICAN), Chima Titus Nwokoji; former spokesperson of the Central Bank of Nigeria (CBN), Isa Abdul-Mumin; Director of Communication and Public Affairs, NDIC, Bashir Nuhu; and Group Chief Financial Officer of Parthian Partners, Olayinka Arewa, at the Finance Correspondents Association of Nigeria (FICAN) 2024 annual conference in Lagos.

Arewa highlighted that while the 2004 exercise set a benchmark of $250 million (₦25 billion), today’s requirements—adjusted for inflation and exchange rates—are roughly equivalent at $300 million. He emphasised that Nigeria’s youthful population, with an average age of 19, will drive further changes in the financial landscape.

National Chairman of FICAN, Mr. Chima Titus Nwokoji, added that Nigeria’s ambition to become a $1 trillion economy by 2025 or 2026 requires bold reforms, including bank recapitalisation to enhance financial intermediation and support fintechs and the real sector. He mentioned that estimates suggest the recapitalisation could inject ₦3.3 trillion into the banking system, creating significant economic benefits.

Other notable speakers at the workshop included UBA’s Executive Director of Finance and Risk Management, Mr. Ugochukwu Nwaghodoh, NDIC Managing Director, Mr Hassan Bello, former CBN spokesperson, Mr Isa Abdul-Mumin, NDIC Director of Communication and Public Affairs, Mr Bashir Nuhu, NIBSS Head of Strategy and Research, Mr. William Uko, and BOI Divisional Head of Services Industries, Dr. Isa Omagu.

Read more on SuperNews, ThisDay, NewTelegraph