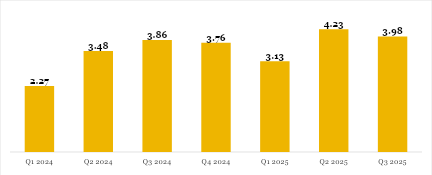

Q3 2025 Growth Moderates but Remains Broad-Based

Nigeria’s economic growth remained on a positive trajectory in Q3 2025, although the pace moderated slightly relative to the previous quarter. According to the latest data released by the National Bureau of Statistics (NBS), real GDP grew by 3.98% year-on-year, easing from 4.23% in Q2 2025 but still surpassing the 3.86% recorded in Q3 2024. In nominal terms, total output rose to ₦113.59 trillion, up from ₦101.73 trillion in the preceding quarter and ₦96.16 trillion in Q3 2024, reflecting both output gains and elevated price levels.

The Oil and Non-oil Sector Performance

Oil Sector

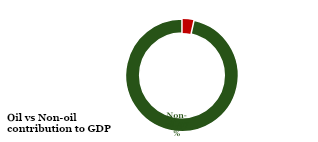

The oil sector grew by 5.84% year-on-year, slightly higher than the 5.66% expansion recorded in Q3 2024, but significantly slower than the 20.46% surge posted in Q2 2025. The moderation highlights the volatility of crude oil output and the persistence of operational and security-related constraints. Notably, oil production was down to 1.64 million barrels per day (mbpd) in Q3 2025 from 1.68 mbpd in Q2 2025, but higher than the 1.47mbpd recorded in Q3 2024. The sector contributed 3.44% to real GDP, marginally above the 3.38% recorded a year earlier but below the 4.05% share reported in the previous quarter.

Non-oil Sector

The non-oil sector maintained its steady momentum in the third quarter of 2025, further reinforcing its position as the primary engine of economic expansion. The sector grew by 3.91% in real terms, outperforming both the 3.79% recorded in the same period of 2024 and the 3.64% posted in the second quarter of 2025. This improvement highlights the resilience and broad-based contributions of non-oil activities despite ongoing macroeconomic pressures. Strong performance in agriculture (particularly crop production), financial services, trade, construction, and manufacturing underpinned the sector’s resilience.

The non-oil sector accounted for 96.56% of total real GDP, slightly lower than the 96.62% reported a year earlier but higher than the 95.95% recorded in the previous quarter, reaffirming its dominant role in Nigeria’s growth narrative.

Sectoral Analysis – 24 Expanded, 20 Slowed, and 2 Contracted

A breakdown of the report showed that of the 46 activities tracked by the NBS, 24 expanded, 20 slowed, and 2 contracted.

Growth across the key constituent sectors varied in strength. Agriculture expanded by 3.79% YoY and contributed 31.21% to real GDP, supported by the impact of the harvest. Manufacturing delivered modest progress with a real growth rate of 1.25%, although its GDP share slipped slightly to 7.62%. This improved growth was supported by FX stability, increased domestic refining activities, and gradually improving consumer purchasing power. Construction maintained a healthy pace, growing by 5.57% YoY and improving its contribution to 3.80%, supported by increased construction activities, especially in the public sector. Trade recorded a measured improvement with 1.98% growth, but its share of GDP declined to 16.42%. The positive output movement was supported by FX stability and improving consumer purchasing power.

However, real estate growth eased to 3.5% from 3.79% in Q2 2025, as higher spending on essentials (food, transport, and rent) left households with less capacity for private construction. The continued shift to hybrid work and shared office spaces also weighed on commercial real estate demand. Transport activities similarly remained pressured by insecurity and rising transport costs across road, rail, and air segments.

Outlook for Q4 2025

The outlook for Q4 2025 remains cautiously optimistic. Growth is expected to stabilize around the 4% mark, supported by the late harvest season, increased festive demand, and gradually improving investor sentiment driven by ongoing disinflation and enhanced FX liquidity. Nonetheless, several headwinds persist, including oil production volatility, bearish oil price movement, fiscal pressures, rising insecurity, and the lingering effects of tight, though gradually easing, monetary conditions on credit expansion.

Over the medium term, the growth outlook for 2026 is moderately positive. Easing interest rates should begin to revive private consumption and investment. Reforms and improved FX inflows are expected to support higher productivity. Overall, these dynamics suggest that Nigeria is positioned to consolidate its recovery, provided reform momentum is sustained, and structural bottlenecks are addressed.