Nigeria’s Inflation Eases Further to 14.45% in November

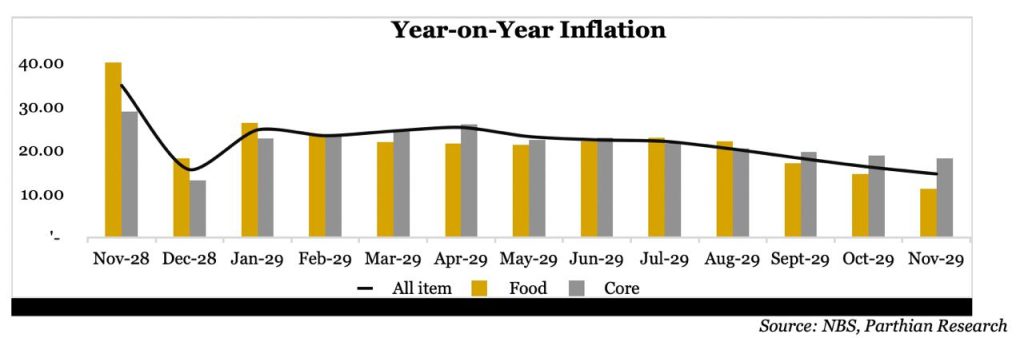

As widely expected, Nigeria’s inflation maintained its downward trend in November, with headline inflation easing to 14.45% year-on-year from 16.05% in October. This marks the seventh consecutive month of disinflation. The moderation reflects improving macroeconomic conditions and favourable base effects. Softer price pressures were particularly evident in the food segment, supported by improved supply from the late harvest season and relatively stable logistics costs, with food inflation declining to 11.08% from 13.12%. Core inflation also slowed to 18.04% from 18.69%, underscoring easing underlying price pressures amid relative exchange-rate stability.

Festive Pressures Lift MoM Prints to 1.22%

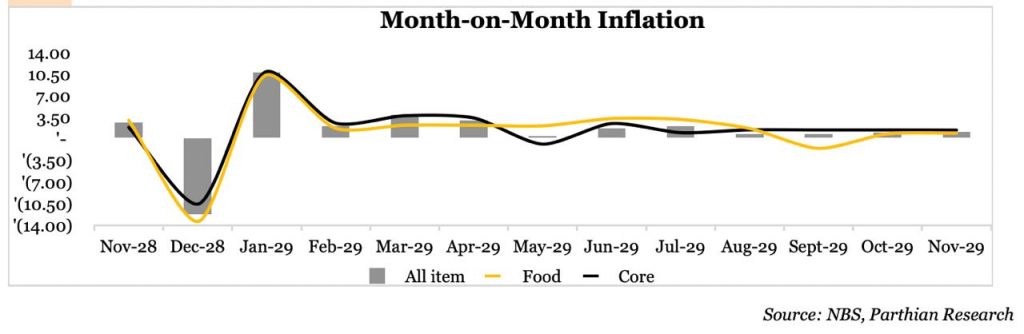

However, month-on-month inflation, which is often a better gauge of near-term price dynamics, picked up to 1.22% in November from 0.93% in October. The acceleration largely reflects pre-festive demand pressures, which typically boost consumption, especially across food-related items.

Food Inflation moderates to 11.08%

Food inflation moderated sharply on a year-on-year basis to 11.08% in November, down from 39.93% in November 2024 and 13.12% in October 2025, reflecting base effects and improved food supply conditions. However, month-on-month food inflation rebounded to 1.13% from a -0.37% decline in October, driven by price increases across key staples such as dried tomatoes, cassava tubers, eggs, crayfish, fresh onions, and other protein and condiment items. While the favourable base effect and late harvest continued to ease annual food price pressures, the monthly uptick points to seasonal demand effects ahead of the festive period.

Core Inflation down to 18.04%

On a year-on-year basis, the core index declined marginally to 18.04% from 18.69% in October. On a month-on-month basis, core inflation slowed to 1.28% in November from 1.42% in October. This was partly supported by a relatively stable foreign exchange environment.

Implications

The moderation in headline inflation in November is positive for the economy, supporting real purchasing power, easing business cost pressures, and strengthening the case for a potential rate cut in February. However, as markets have largely priced in continued disinflation, any further decline in effective interest rates is likely to be gradual, especially given the need to keep yields attractive for government funding. Equities should remain key beneficiaries, particularly consumer and rate-sensitive sectors, as a more predictable inflation and interest-rate environment supports earnings and valuations, while risks of capital outflows appear contained.

December Inflation Outlook

Headline inflation may experience a modest rebound in December, reflecting the interplay of seasonal demand pressures and diminishing base effects. The earlier disinflationary support from the rebasing exercise is waning, as the shift to a 2024 base year, which initially lowered year-on-year inflation through favourable comparisons, has now largely been absorbed. With this low base now fully reflected in the annual readings, a temporary uptick in headline inflation is likely in December.