December Inflation Forecast: A Base-Driven Uptick Amid Easing Price Pressures

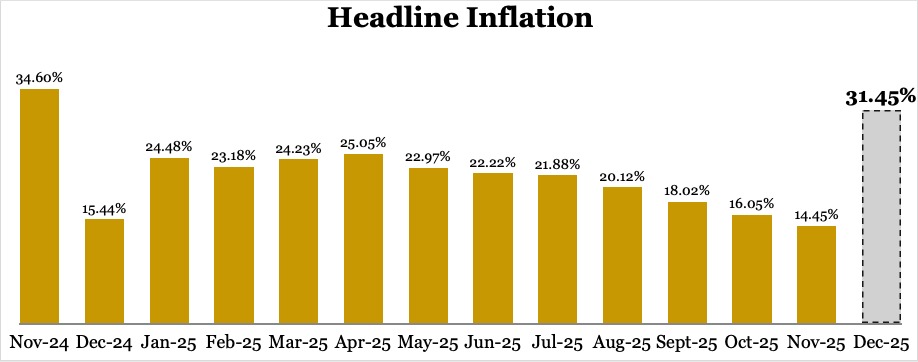

The National Bureau of Statistics (NBS) is expected to release the December 2025 inflation report this week (January 15). At Parthian Partners, we project headline inflation to edge higher to 31.45% y/y, marking a potential break in the eight-month disinflationary trend.

However, we view the anticipated uptick as largely transitory rather than the start of a renewed inflationary cycle, as it is expected to be driven primarily by base effects. Recall that the Consumer Price Index (CPI) was rebased in January 2025, with December 2024 adopted as the new base period and indexed to 100. Consequently, the statistical base is now less supportive of year-on-year disinflation, even as underlying price pressures continue to ease.

Encouragingly, month-on-month inflation, which better captures current price dynamics, is expected to moderate sharply to 0.77% in December from 1.22% in November. This projected slowdown reflects improving macroeconomic conditions, including higher agricultural output, easing supply constraints, and a relatively stable Naira.

Cost-push pressures also softened during the month. The Dangote Refinery’s reduction in the pump price of PMS to ₦739/litre, particularly across MRS retail outlets, helped to stabilize fuel prices and ease transportation and logistics costs. In addition, international crude oil prices remained largely bearish, providing further relief to domestic energy-related inflation pressures.

Policy Implications

From a policy perspective, the expected rise in headline inflation is unlikely to alter the Central Bank of Nigeria’s (CBN) near-term policy stance, as the underlying disinflationary momentum remains intact. The anticipated moderation in month-on-month inflation reinforces the case that price pressures are gradually easing, even as base effects distort the year-on-year reading.

Nevertheless, the CBN is likely to maintain a cautious posture, keeping monetary conditions tight to consolidate recent gains in inflation control, anchor inflation expectations, and preserve foreign portfolio inflows. Any consideration of policy easing is more likely to be driven by sustained improvements in month-on-month inflation and food price stability, rather than a single headline print.

Fixed-Income and Yield Curve Implications

The expected inflation outcome presents a measured backdrop for the fixed-income market. While the projected uptick in headline inflation may limit near-term expectations of aggressive monetary easing, the anticipated moderation in month-on-month inflation reinforces the view that underlying price pressures are easing.

Hence, we expect yields at the short end of the curve to remain relatively firm, reflecting the CBN’s cautious policy stance and the need to preserve attractive real returns to support domestic and foreign investor participation. Conversely, improving inflation dynamics should continue to underpin demand at the mid-to-long end of the curve, supporting selective accumulation.

Money market instruments, including NTBs and OMO bills, are likely to remain elevated in the near term as the authorities balance inflation management with fiscal funding requirements. The pressure on short-term rates is further reinforced by the 2026 budget, which projects the fiscal deficit to widen by 82.34% to ₦23.85 trillion from ₦18.08 trillion. This larger funding gap implies increased domestic borrowing needs, thereby providing supply pressures in the money market and limiting the scope for a meaningful decline in short-end yields despite easing inflation momentum.

Equities: Sector Positioning Implications

For equities, the inflation outlook is marginally supportive, particularly for sectors that benefit from easing cost pressures and stabilizing macro conditions.

- Consumer Goods: Softer month-on-month inflation and easing logistics costs should gradually support margins, especially for FMCGs with strong pricing power.

- Industrial Goods: Lower energy and transportation costs remain positive for cement and building materials producers, supporting margin recovery.

- Banking: A prolonged tight-rate environment continues to support interest income and asset yields, although moderation in rates over time could compress margins.

- Agriculture-linked stocks: Improved output supply support earnings visibility, particularly for firms exposed to domestic food supply chains. The sector is also expected to benefit from Zero-rated VAT as stated in the new Finance Act. However, insecurity remains a major threat in the agric sector.