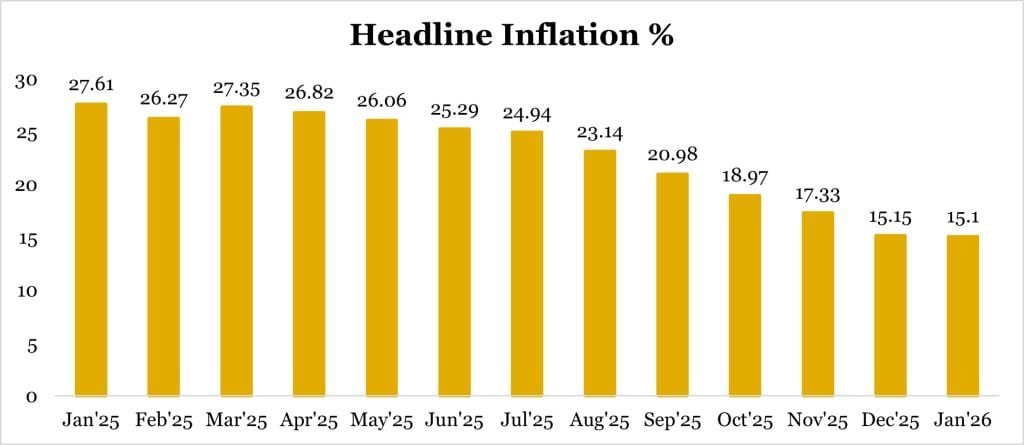

Headline Inflation Eases to 15.1% in January

Contrary to expectations, Nigeria’s headline inflation maintained its downward trajectory in January 2026, easing slightly to 15.10% year-on-year, down from 15.15% in December 2025. This marks the tenth consecutive month of disinflation, reflecting a sustained moderation in price pressures. While the year-on-year decline was modest, the month-on-month data tells a more striking story: consumer prices contracted by 2.88% in January, highlighting a notable softening in short-term inflation.

Several factors contributed to this moderation. The decline in PMS prices in December by the Dangote Refinery (even though prices were revised upwards in February), helped lower logistics costs and eased cost-push pressures across both food and core items. In addition, the Naira strengthened in January, creating a pass-through effect that helped moderate imported inflation. Improved commodity supply following the harvest season also bolstered market inventories, easing food price pressures. On the demand side, consumer spending normalized after the December festive surge, reducing short-term demand-pull pressures.

Food Inflation falls below 10%, for the first time in over a decade

Food inflation recorded a significant slowdown, declining to 8.89% year-on-year in January 2026 from 10.84% in December 2025. More notably, food prices contracted by 6.02% month-on-month, compared to -0.36% in December, pointing to a substantial easing in food price pressures and improved market supply dynamics.

Core Inflation Eases to 17.72%

Core inflation moderated to 17.72% year-on-year in January 2026, down from 18.63% in the preceding month, signaling a gradual cooling in underlying price pressures. On a monthly basis, core inflation came in at -1.69% in January, down from 0.58% in December, suggesting that disinflation is becoming more broad-based beyond food items.

Inflation Outlook for February

Inflation is likely to continue its downward trend in February, largely supported by sustained Naira stability. However, the onset of the Ramadan fast and Easter celebrations may temporarily push prices higher in March and April.

Policy Implications: Case for a Rate Cut Strengthens

The persistence of the disinflation trend reinforces confidence that earlier monetary tightening measures are gaining traction. In our view, the sustained moderation across headline, food, and core metrics strengthens the case for a policy rate cut at the upcoming Monetary Policy Committee (MPC) meeting of the Central Bank of Nigeria.

We project a 100–200 basis points reduction in the benchmark rate, reflecting improved inflation dynamics and the need to support economic growth.

Monetary Policy Decision

For the Monetary Policy Committee (MPC), the January inflation print presents a delicate balancing act. The projected jump in the annual rate could, on the surface, reinforce hawkish concerns. However, a closer examination reveals that the increase is largely technical and that underlying momentum is moderating. The slowdown in month-on-month inflation suggests that prior monetary tightening, liquidity management measures, and exchange rate reforms are gaining traction.

We therefore expect the MPC to look beyond the optical impact of the higher year-on-year figure and focus on underlying price dynamics. A hold decision at the next policy meeting appears most likely, as the Committee continue to assess the sustainability of disinflationary trends under the recalibrated framework.