Q3′ 2022 – 30 SEPTEMBER 2022

Macro-Economic Overview

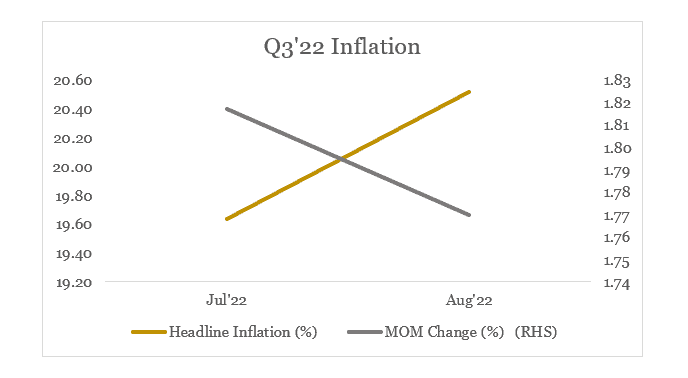

This quarter recorded a consistent rise in inflation by c.448bps to close at 20.52% as of August 2022. This hike was on the back of rising prices of goods and services, which could be partly attributed to the ongoing Russia-Ukraine crisis.

In an aggressive bid to tame inflation, the MPC hiked MPR by 100bps and 150bps in the July’22 and September ’22 meetings respectively, while retaining the asymmetric corridor of the MPR at +100 / -700 basis point and Liquidity ratio at 30%; however, CRR was increased by 500bps to 32.5% at the September ’22 meeting. These rate hikes led to an upward trend in yields in the fixed-income market.

Oil prices this quarter averaged $101.15/b vs $111.83/b recorded in Q1 2022. The quarter commenced with prices at c.$122/b as economic recovery fears eases, however, towards the end of the quarter as demand fears rose on the back of fresh China lockdowns and recession fears. Brent crude closed the quarter c.27% down at $88.17/b

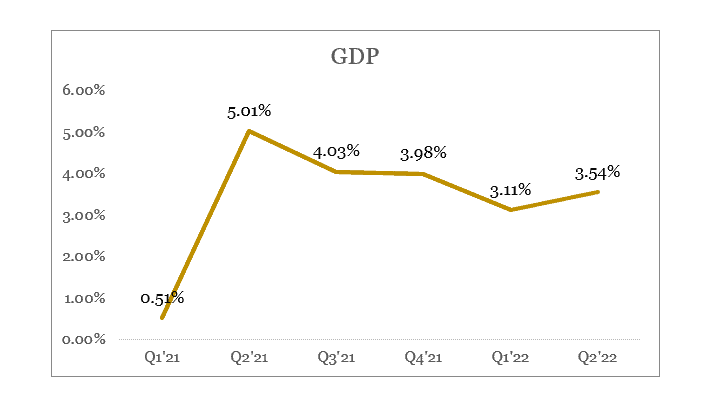

Nigeria’s gross domestic product (GDP) grew by 3.54% year-on-year in real terms in the second quarter of 2022, an improvement compared to the 3.11% growth recorded in the previous quarter. Q2 figures indicate the seventh consecutive quarter of GDP growth in the country since the recession recorded in Q3 2020.

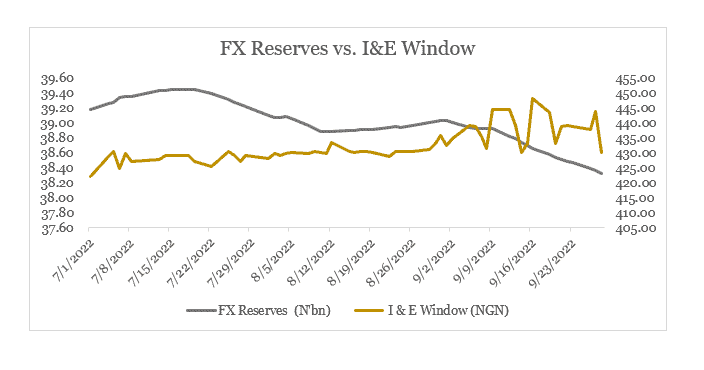

The Nigerian FX reserve declined by 2.18% to close at $38.32bn, as crude oil prices trend downwards amid economic worries.

Interbank liquidity this quarter averaged N98bn, closing the quarter at c.N959bn as banks funded for their CRR and Retail SMIS auction debits.

FAAC disbursement in Q3 2022 declined by c.N435m% QoQ. Total FAAC disbursement for the quarter was N1.63bn, with DMBs getting N345bn in inflow.

|

Bond market Forging ahead from Q2, bond yields have risen by an average of 267bp,s quarter to date, and we attribute this to the prevalent hawkish stance of the CBN. Starting the quarter, bullish sentiments were dominant on the back of inflows from bond coupons (c.N695bn for the quarter). However, following the MPR hike and liquidity dearth amid investors’ appetite for a high-yield environment, the bond market closed the quarter on a bearish note. During the quarter, the DMO offered a total of N675bn but sold N585.92bn on 2025, 2032, 2037, and 2042 bond papers. The 2042 paper was replaced with the 2037 paper by the DMO at the third auction of the quarter. Stop rates in the period rose from 10.10%, 12.50% and 13.15% in Q2, to 13.50%, 13.849% and 14.00% in Q3, on the 2025s, 2032s and 2042s respectively. Similarly, the 2037s reopened at 14.50%. |

|

Treasury bill market The treasury bill market was largely bearish in the third quarter of the year, attributable to weak demand for instruments and persistent system illiquidity. Despite declining stop rates, the NTB auctions were heavily subscribed to. Special bills (28-Nov, 12-Dec) remained the most actively traded papers, with yields closing at 6.95% and 7.50%, respectively, as investors sought higher yields. The bearish sentiment persisted till the end of the quarter, as banks looked to sell bills to raise liquidity for the bond auction debit, CRR debit, and FX retail auction. Yields in the treasury bill market thus inclined Q-o-Q by an average of 162bps. Through the quarter, a combination of improved system liquidity and limited CBN supply drove a bullish bias in the OMO space. Levels in the market inclined Q-o-Q by an average of 467bps. |

|

Eurobond Market The SSA Eurobond market had another quarter dominated by the bears. As the US Fed continues its rate hikes (3x 75bps), investors flee to safety to the greenback, as Fed Chair Jerome Powell expressed unlikeliness to hold back on its hawkish posture, stressing its inflation target of 2%. level. Fears of demand destruction and thus a recession led to depressing prices on risky Eurobond papers of emerging and frontier markets in the third quarter of the year 2022. Country event Nigeria In line with the global risk-off sentiment, the Nigerian Eurobond curve expanded by 139bps during the quarter. Events during this period revealed the weakened fiscal position of the Nigerian economy. January to April budget performance published by the Ministry of Finance in July showed that debt service cost was more than retained earnings by N310bn. Also, with increased borrowing costs in the local market given the consistent MPR hikes, Nigeria’s ability to service its debt increasingly becomes threatened. Ghana Activity on the Ghana Eurobond papers was driven by developments on their IMF program, as the government faced yet another quarter of fiscal scrutiny. Given the delays in IMF intervention, yields on the Ghana Eurobond curve quarter-on-quarter increased by over 800bps. Toward the end of the quarter, the IMF Staff conducted a visit to continue discussions on policies and reforms under the loan program request. This was followed by a second downgrade (for the year) further down the junk region (cc), by Fitch, given the increasing possibility of restructuring their debt, and as a result, less priority will be granted to external investors. Kenya Just like its peers, the Kenya sovereign curve had a bearish run in the third quarter of 2022. Yields on KENINT Eurobond papers increased by c.20bps. Kenya during the quarter was faced with developments of general elections, where an opposition candidate emerged as president, after a Supreme Court challenge by incumbent Raila Odinga. Inflation in Kenya accelerated to 8.50%, due to an increase in food and energy prices. The newly sworn-in president is expecting to cut subsidies, among other reforms to keep Kenya on a sustainable growth trajectory. Zambia Zambia’s Eurobond paper had a quarter driven by fears of default on debt obligations by the government. Yields on Zambia’s sovereign curve climbed by over 1,000bps. Fears (by investors) of a default on the $750m 20th September 2022 Eurobond paper materialized, as holders of the Eurobond paper were not paid at maturity. With a $ 1 billion due to mature in 2024, the conversation is underway to restructure the south African country’s debt, via a $1.3 billion 38-month loan from the IMF. |

|

Q3 2022 Outlook

|