Fixed Income Quarterly - Q3 2024

Macro-Economic Overview

Nigeria’s inflation moderated to 32.15% in August from 33.40% in July, with food inflation easing to 37.52% and core inflation inching up to 27.58% in the same month.

To contain the fast-rising consumer prices, the MPC maintained its hawkish stance, as the MPR was increased by 50 bps to 26.75% in July, following a further jump to 27.25% in September. The asymmetric corridor was retained at +500/-100 in September while the CRR was increased to 50% from 45%. The liquidity ratio was retained at 30%.

Oil prices averaged $79.77/b in Q3, dipping at $69.19/b on the 10th of September, on the back of the crisis at the middle-east, lower demand, and uncertainty over OPEC’s demands

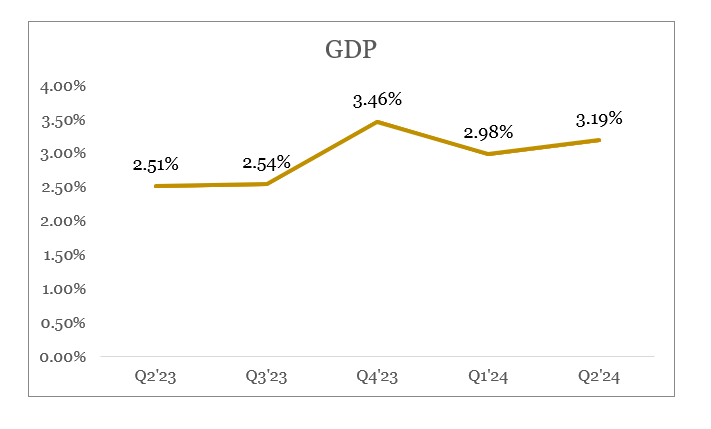

Nigeria’s Gross Domestic Product (GDP) grew by 3.19% y-o-y (year-on-year) in real terms in Q2 2024, coming from a 2.98%y-o-y recorded in Q1 ‘2024. The growth recorded was largely driven by the service sector, which recorded a growth of 3.79%y-o-y and contributed 58.76% to the aggregate GDP

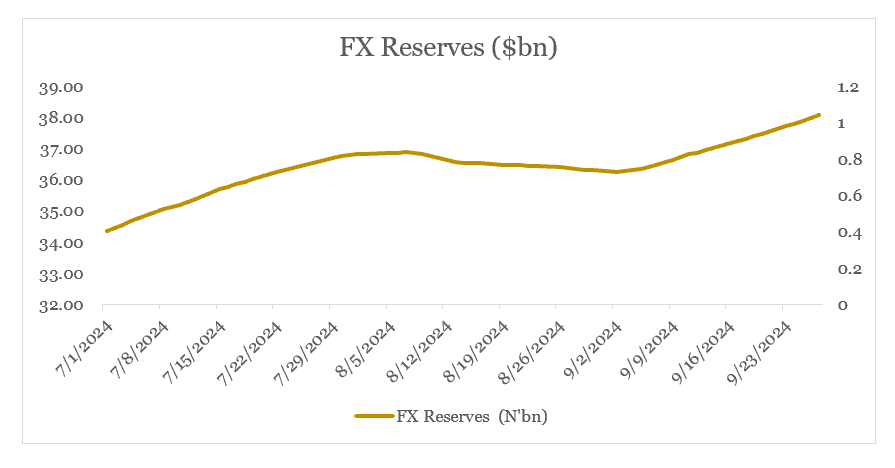

The Nigerian FX reserve currently stands at $38.2bn (27th September,2024).

Interbank liquidity averaged repo c.N62bn through the quarter, with a high of c.N1.2trn in August and a low of repo c.N1.44 trn in July.

The Total FAAC disbursement for the quarter stood at c.N3.76 trn with July recording the highest at c.N1.358 trn.

Market Performance in Q3-2024

Bond market

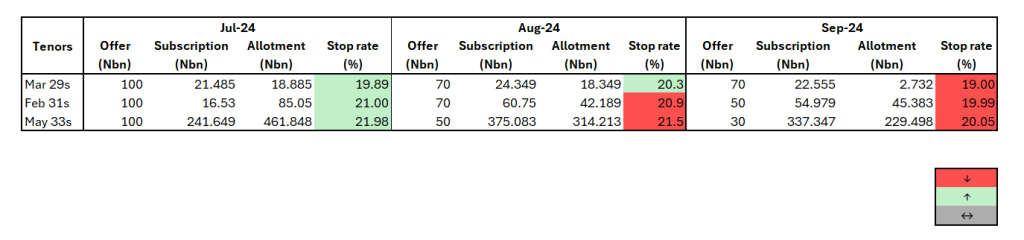

Commencing the quarter, market participants traded cautiously amid bearish bias as players anticipated the outcome of the scheduled MPC meeting. Following the auction, the bond curve adjusted as bearish sentiments strengthened amidst profit-taking activities and liquidity constraints. Leading to the August auction, the DMO announced a reduction in the bond auction offer amount from N300bn to N190bn. This led to a reversal in market sentiments as players started covering their open short positions. Following the August auction which saw a decline in stop rates, the bullish bias intensified leading to yields declining by c.80bps MoM. A further reduced offer size (to N150bn) for the September auction drove bullish bias, which was quite short-lived, as yields direction reversed following the MPC meeting outcome. Closing the quarter, mixed sentiments were recorded across the bond curve, especially on the mid to long end, albeit with a bearish tilt. Through the quarter, major activities were recorded on the 29s, 31s, 33s, 34s, 38s, and 53s. QoQ, yields declined by an average of c.99bps.

The DMO offered a total N640bn at the bond auctions for the quarter, overselling by c.N578bn across the 2029, 2031s and 2033 tenors, with stop rates closing the quarter at 19.00%, 19.99% and 20.05% respectively.

Treasury bill market

The treasury bills market experienced a bearish trend at the start of the quarter, with the average rates in the space rising by c.199bps, closing at c.24.02% by the end of the first month. This was primarily driven by tight liquidity conditions and higher stop rates observed in the primary auction held in July. As the quarter progressed, bullish sentiments emerged into August, despite fluctuations in system liquidity. During this period, investor buy interest was focused on the mid-to-long end of the curve, amid scarce offers to match. Consequently, the average yield declined by c.271bps, in the second month of the quarter. Towards the end of the quarter, market participants adopted a cautious trading approach in anticipation of the MPC meeting, leading to a bearish undertone re-emerging. Most activity was seen on the auction papers, which remained relatively scarce in the market. However, closing the quarter, the selling pressure waned as players maintained a cautious stance. Overall trading volume remained low despite the pockets of demand seen on the back of the elevated system liquidity.

The CBN floated eight OMO auctions during the quarter offering c. N3.8trn across the standard tenors. Sales through the quarter was about N2.3trn despite the oversubscriptions recorded at the auctions. There was one no sale auction in the quarter, similarly to the previous quarter.

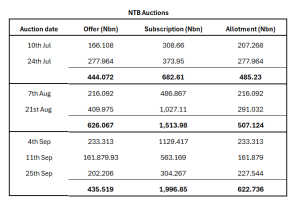

The DMO conducted seven auctions through the quarter with each month recording about 1.6x, 3.6x, 8.3x oversubscription respectively. In total, the FG oversold c. N2.5trn across the standard tenors. Stop rates at the last auction of the quarter increased to 20.00% (vs 16.30% Q2 ending) for the 364-days bill, 17.50% (vs 17.44% Q2 ending) for the 182-days bill and decreased to 17.00% (vs 20.68% Q2 ending) for the 91-days bill.

Eurobond Market

In Q3 2024, the SSA Eurobond market was influenced by a 50bps US Fed rate cut and falling demand from China’s slowing economy. Global volatility was further heightened by geopolitical tensions in the Middle East, with conflicts involving Israel, Iran, and Lebanon, alongside unrest in Libya.

Regionally, Nigeria saw Eurobond yields dip as economic reforms and attractive OMO bill rates drew foreign investors. Ghana’s yields rose due to debt restructuring, despite IMF support and the launch of a new gold refinery. Kenya benefitted from an inflation dip, even amid rating downgrades, while Zambia faced its worst economic crisis in a century, with inflation surging and the kwacha weakening.

Global Economic Factors

- Fed Rate Cut. In September, the U.S. Federal Reserve implemented a 50-basis-point rate cut, a significant move aimed at propping up the slowing U.S. economy. For SSA markets, the rate cut drove demand and could provide relief for refinancing, particularly by lowering the cost of borrowing for countries with outstanding Eurobond obligations. However, the cut also indicated growing concerns about global economic health, which dampened long-term growth prospects for SSA economies reliant on external demand and financing.

- Fall in China Demand. China’s demand continued to fall in Q3, despite several monetary easing measures and the rollout of a stimulus package aimed at reviving domestic consumption and infrastructure spending. SSA economies that depend on commodity exports—such as Zambia (copper), Angola (oil), and South Africa (iron ore)—continue to feel the impact. Chinese imports of these materials remained sluggish, pushing down global commodity prices. Though China’s stimulus efforts were aimed at recovery, the pace of revival was slower than anticipated, prolonging economic strain in the region.

- Yen Carry-Trade Unwind. By September, the unwinding of the yen carry trade sent shockwaves through emerging markets. As the yen appreciated against major currencies, because the Bank of Japan hiked rates (by c.25 bps) for the second time this year, investors started pulling out of riskier assets to cover losses, triggering capital outflows from SSA countries. SSA Eurobond yields spiked in response, making borrowing costs significantly higher. This amplified concerns around debt sustainability, especially for countries that are grappling with rising debt burdens. This was, however, short-lived, as the BOJ did a walkback of its hawkish stance to a more dovish position. The unwinding of this trade highlighted the SSA region’s vulnerability to shifts in global financial flows, especially in times of uncertainty.

- Growing Geopolitical Tensions. Throughout Q3 2024, global geopolitical tensions intensified. In the Middle East, Israel found itself engaged in conflicts on multiple fronts, including battles with Hamas, Hezbollah, and Iranian-backed forces. By September, the situation had escalated further, disrupting oil supply chains. The crisis in Libya, marked by violent power struggles, compounded these disruptions. Oil prices surged, somewhat partly offsetting the fall in Chinese demand. For SSA oil-exporting nations like Nigeria and Angola, the higher prices brought in short-term fiscal gains, though domestic inflation worsened due to rising energy costs. On the flip side, oil-importing countries like Kenya and Ethiopia faced mounting inflationary pressures, which heightened fiscal challenges.

Country Event

Nigeria

Inflation and Economic Reforms: Nigeria’s inflationary pressures remained a dominant theme in Q3 2024, prompting the government to adopt economic reforms like the suspension of import duties on essential goods such as food and pharmaceuticals, announced as a key measure to alleviate inflationary spikes. The Federal Executive Council also approved recommendations of the Presidential Committee on Fiscal Policy and Tax Reforms that offer tax breaks to companies employing more staff. Despite these reforms, inflation remained stubbornly high, largely due to the lingering effects of fuel subsidy removals, currency depreciation and food insecurity.

Growth in Reserves through OMO Bill Issuances: To bolster foreign reserves and manage liquidity, CBN ramped up OMO bill issuances throughout Q3. The OMO bills, which offered attractive yields (effective at c.32% in September) due to two consecutive hikes in MPR, drew strong interest from both local and foreign investors. This led to increased foreign portfolio inflows. As a result, Nigeria’s external reserves experienced modest growth, helping to ease concerns over the country’s ability to meet its foreign currency obligations in the short term. However, the dependency on hot money raised concerns about long-term sustainability.

Local Dollar Bond Issuance: In a landmark move, Nigeria successfully launched its first local dollar-denominated bond in September 2024, raising $900 million at a 9.75% coupon. This issuance was aimed at providing an alternative investment vehicle for local and diasporan investors who sought dollar exposure without directly tapping into international markets. The bond issuance was oversubscribed by 180%, reflecting strong market confidence in Nigeria’s ability to manage its dollar-denominated debt. This also helped to absorb excess liquidity from the system and provided a new tool for fiscal management. The success of this issuance signalled a potential shift in Nigeria’s domestic capital markets, opening the door for future dollar-denominated offerings, especially as the full programme is $2 billion.

Nigeria Eurobond Market Performance: Nigeria’s Eurobond yields dropped by 59 bps in Q3, reflecting positive investor sentiment following the US Fed rate cuts, as well as the government’s concerted efforts to stabilise the economy. The Central Bank of Nigeria’s decision to attract foreign portfolio inflows has helped boost reserves.

Ghana

- Debt Rework and Eurobond Exchange: Ghana’s debt restructuring efforts took a significant step forward in Q3 2024, with the government finalising the terms for a Eurobond exchange programme. The deal reached allows them to choose between two alternatives: the DISCO or PAR option. In the first option, investors will take a 37% haircut and receive interest payments of 5% from this year to July 2028, and 6% interest thereafter. Bondholders who pick PAR won’t face any nominal losses but get 1.5% interest on the new bonds maturing in January 2037. The exchange programme has seen moderate participation from bondholders, as investors will be able to swap their debt until September 30, while they meet with investors on October 3rd.

First Commercial Gold Refinery: In a bid to enhance value addition in its key mining sector, Ghana inaugurated a new gold refinery in August. The Royal Ghana Gold Refinery – a public-private partnership between Rosy Royal Minerals of India and Ghana’s central bank, in which the bank holds a 20% stake, is expected to process over 400 kilogrammes of gold daily, reducing the need for raw gold exports and increasing local value retention. The refinery forms part of Ghana’s broader strategy to diversify its economy and reduce dependence on foreign exchange from traditional exports like cocoa and crude oil, which would boost government revenues through higher export value and improve the country’s trade balance.

Inflation and Interest Rate Cut: In an effort to stimulate growth amidst challenging economic conditions, the Bank of Ghana cut its benchmark interest rate by 200 basis points in September, bringing the rate to 27%. The central bank’s decision was influenced by the easing inflationary pressures, which had peaked in the previous year and showed signs of stabilizing. Inflation had dropped from 22.8% in June to 20.9% in July and 20.4% in August. Lowering the interest rate was aimed at encouraging lending and investment, as the country sought to balance its efforts to spur growth with ongoing fiscal consolidation under the IMF programme.

Ghana Eurobond Market Performance: Ghana’s Eurobond yields rose by approximately 38 bps in Q3, as lingering concerns over debt sustainability and economic challenges outweighed the positive developments. While the IMF’s $360 million loan provided a cushion, the government’s debt restructuring efforts and Eurobond exchange programme created uncertainty in the market. Investors remained cautious, especially given the ongoing economic reforms and the opening of the new gold refinery, which, while promising, has yet to yield tangible revenue impacts. The Bank of Ghana’s benchmark interest rate cut was a step towards stimulating the economy, but it also raised concerns over inflationary pressures.

Kenya

Credit Rating Downgrade: Kenya faced significant financial challenges in Q3 2024, with its credit ratings being downgraded by both Fitch and Moody’s within weeks of each other. In early August, Fitch Ratings cut Kenya’s long-term foreign-currency rating to B- from B, citing rising debt levels and concerns about the country’s fiscal management. Similarly, in July, Moody’s downgraded Kenya to Caa1 from B3, reflecting fears about the country’s ability to meet its debt obligations without external support.

Consideration of a Fresh IMF Programme: As Kenya’s fiscal pressures mounted, discussions about seeking a fresh financial arrangement with the IMF gained momentum. In July 2024, government officials hinted at the possibility of negotiating a new IMF programme to help navigate the country’s growing debt burden and fiscal imbalances. While Kenya was already under an IMF programme aimed at fiscal consolidation, the government’s mulling over an additional facility highlighted the strain on public finances and the need for external support. Kenya’s current three-year IMF programme for $3.6 billion is scheduled to end in April 2025.

Inflation and Interest Rate Cut: Kenya’s inflation remained relatively contained in Q3 2024, with inflation falling slightly from 4.6% in June to 4.3% in July before inching up to 4.4% in August. This relative stability, combined with slowing economic growth, prompted the Central Bank of Kenya (CBK) to take an unprecedented step. In August, the CBK cut its benchmark interest rate by 25 basis points to 12.75%, marking the first rate cut in four years. This decision was made in a bid to stimulate borrowing and investment, as the country sought to counter the impact of high debt service costs and external headwinds on the economy.

Kenya Eurobond Market Performance: Amid the US Fed rate cut programme, Kenya’s Eurobond yields saw a sharp drop of 130 bps in Q3, reflecting a temporary boost in investor confidence following the government’s decision to pursue a fresh IMF programme. Despite the credit rating downgrades by Fitch and Moody’s, the IMF discussions signalled a potential lifeline to address the country’s debt challenges.

Zambia

Severe Drought and Economic Challenges: Zambia faced its most severe economic downturn in over a century, driven by the worst drought the country had experienced in 100 years. This natural disaster severely impacted agricultural production, one of Zambia’s key economic sectors, leading to a drastic reduction in tax revenues. As a result, in September 2024, the government halved its economic growth target for the year to 2.3%, down from earlier forecasts of 4.5%. The drought not only stunted economic growth but also triggered broader fiscal challenges, contributing to the weakening of the kwacha, which depreciated by 11% against the US dollar since February 2024. To help combat the crisis, Zambia received a $208 million grant in July from international donors, aimed at mitigating the impact of the drought and providing immediate relief to affected communities.

Surging Inflation and Interest Rate Stability: The combination of supply shortages from the drought and rising global commodity prices saw Zambia’s inflation surge to multi-year highs throughout Q3 2024. Inflation climbed steadily, reaching 15.4% in July, then 15.50% in August, and peaking at a near four-year high of 15.6% in September. Food prices continued to drive inflation upward, exacerbating the country’s cost of living crisis. To balance economic pressures, Zambia’s central bank decided to maintain its key interest rate at 13.5% for the first time in almost two years. This decision followed six consecutive rate hikes, amounting to a total increase of 450 basis points since the tightening cycle began.

Border Closures and Copper Trade Disruption: In August, Zambia temporarily closed its border with the Democratic Republic of Congo (DRC), a key route for its copper exports, due to security concerns and trade-related tensions. The closure disrupted copper shipments, one of Zambia’s primary revenue sources, and threatened to further weaken the country’s economic position. However, following diplomatic negotiations, the border was reopened, restoring the vital copper trade route. While the reopening of the border provided some relief to copper exporters, the temporary closure underscored the vulnerability of Zambia’s economy to external shocks, especially given its reliance on copper for export revenues.

Q4 2024 Outlook

Local Market

Local market

We expect to see continued cautious stance going into the last quarter of the year, albeit with a bearish bias on the back of the CBN’s hawkish policies. Nevertheless, given that out of the c.N3.9trn expected inflows from coupon payments and bills maturities in Q4, c.67% is expected within the last two months, we anticipate pockets of demand towards the end of the quarter, as players look to lock in idle cash.

Eurobond market

- Further US Fed Rate Cut Anticipation: Market participants are anticipating further rate cuts from the US Federal Reserve following the 50bps cut in Q3. With inflation in the US showing signs of easing, another cut could be on the horizon. This would likely improve risk sentiment towards SSA Eurobonds, as lower US rates typically lead to reduced borrowing costs for emerging markets and increased demand for higher-yielding assets in SSA countries.

- Country-Specific Outlooks:

- Nigeria’s Dollar Bond Issuance with Respect to the Full $2bn Programme: Nigeria is expected to continue its dollar bond issuance under the broader $2 billion Eurobond program. Having issued a tranche earlier in the year, the Nigerian government is expected to tap the markets again in Q4 to complete the program.

- Egypt Planned Eurobond Issuance: Egypt is preparing to issue Eurobonds in Q4, which could attract significant market attention. With its large debt burden and ambitious reform programme, this issuance will be critical for the country’s external financing needs. Investors will closely monitor Egypt’s fiscal reforms, foreign exchange reserves, and ongoing IMF programme to gauge the bond’s attractiveness.

- Kenya’s Diaspora Bond Plans: Kenya is exploring the possibility of issuing a diaspora bond in Q4 to tap into its overseas population for cheaper financing. This comes as part of broader efforts to diversify funding sources, especially given the country’s reliance on the IMF programme and ongoing fiscal consolidation. While the diaspora bond could provide a steady stream of inflows, success will hinge on investor confidence in Kenya’s ability to manage its fiscal and debt challenges, especially after recent credit rating downgrades.

- Zambia Eyes World Bank Catastrophe Funds by Year End: Zambia, grappling with the worst drought in a century, is looking to secure World Bank Catastrophe Funds by year-end. With drought devastating agricultural output and reducing tax revenues, these funds will be critical for disaster recovery and social programmes. Zambia’s fiscal outlook remains challenging, especially with inflation pressures and ongoing debt restructuring. Securing the catastrophe funds will provide much-needed relief as Zambia works to stabilise its economy.