i-invest New Update Offers More Convenience for Financial Control

A lot of us have experienced that moment when we feel like we are just barely keeping our financial life above water. If nothing at all, last year’s pandemic taught us the importance of financial planning and control. Taking control of our finance can help reduce financial stress caused by debt, unplanned expenses, or an impulse to spend on things we can’t afford. Reducing financial stress requires taking action on saving, budgeting, and investing.

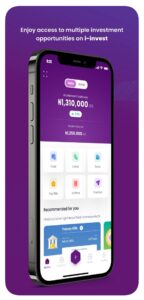

Recently, Parthian Partners added some vital features to i-invest, Nigeria’s foremost digital platform that allows you to securely purchase and manage Treasury Bills, Eurobonds, and Equities. These new features make i-invest an integrated platform for finance management. As such, rather than having several applications downloaded on your mobile device for different financial transactions, you can now manage your money in one place on the i-invest app. Here’s how:

1. Personalized Savings: With the new SAVE feature, you can choose how you want to save your money depending on your goals. You can either use the autosave feature which allows you to set automatic recurrent savings over a period or lock-in an amount at once over a period. The best part of i-invest savings is that, unlike a regular savings account, your money doesn’t just sit idly in your saving account but grows at a reasonable interest rate monthly. Rates presently range from 8% to 11% interest.

2. Pay Electricity Bills and buy Airtime & Data: This feature takes out the stress of bill payment.

3. Invest in Naira Fixed Deposit Note and USD Fixed Deposit Notes: In addition to investing in treasury bills, stocks, and bonds, you can now invest in both Naira and USD Fixed Deposit Notes. With Naira Fixed Deposit Notes, you get up to 11% p.a within 30-90 days tenor.

4. New Look and Friendlier User Interface: i-invest now has a fresh look and easy-to-use interface for that seamless and convenient financial experience.

Although taking charge of one’s finances can be a daunting task to keep up with, having a mobile application like i-invest that helps you save, plan expenses, and invest all in one place can be an important step to financial freedom.