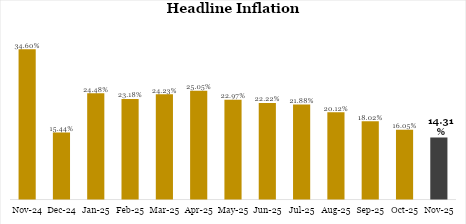

Headline Inflation Expected to Ease to 14.31% in November

The National Bureau of Statistics (NBS) is expected to release the November 2025 Consumer Price Index and Inflation data on December 15. Based on our model, Nigeria’s headline inflation is expected to extend its disinflationary trend in November, moderating further to 14.31% year-on-year, down from 16.05% in October. This would represent the seventh straight month of cooling inflation, reflecting a clear improvement in macroeconomic fundamentals and favourable base effect. Improved food supply conditions from the late harvest season as well as relatively stable logistics costs also contributed to a more benign pricing environment across key consumer baskets.

On a month-on-month basis, however, headline inflation is forecast to rise slightly to 1.09%, up from 0.93% in the previous month. This marginal uptick reflects seasonal demand pressures associated with the festive period.

Harvest-Driven Ease in Food Inflation Amid Mild Seasonal Uptick

Food inflation is expected to ease further, with our model projecting an annual rate of 12.13%, compared to 14.43% in October. Improved domestic food supply, harvest activity, and reduced FX pass-through effects continue to support the deceleration in food prices. Nevertheless, month-on-month food inflation is likely to edge up mildly to 0.91% from 0.79%, in line with seasonal consumption patterns.

Core Inflation Softens Further, Signaling Moderation in Underlying Pressures

Core inflation, which excludes volatile food and energy components, is projected to slow to 18.16% year-on-year from 18.69% previously. The month-on-month measure is also expected to moderate slightly to 1.38%, down from 1.42% in October, reflecting easing pressures across non-food items. This suggests that the underlying inflation trend remains broadly on track, supported by FX stability, improved supply chain conditions, and softening demand under tighter financial conditions.

Outlook and Policy Implications

If accurate, the November data would mark the eighth consecutive monthly decline in headline inflation, providing further validation of ongoing monetary policy tightening and improved FX liquidity conditions. The combination of moderating year-on-year inflation and a contained uptick in month-on-month inflation strengthens the case for a more cautious but progressive shift toward policy easing in early 2026, provided current macroeconomic drivers remain stable.