The Business Impact of Nigeria’s Tax Overhaul

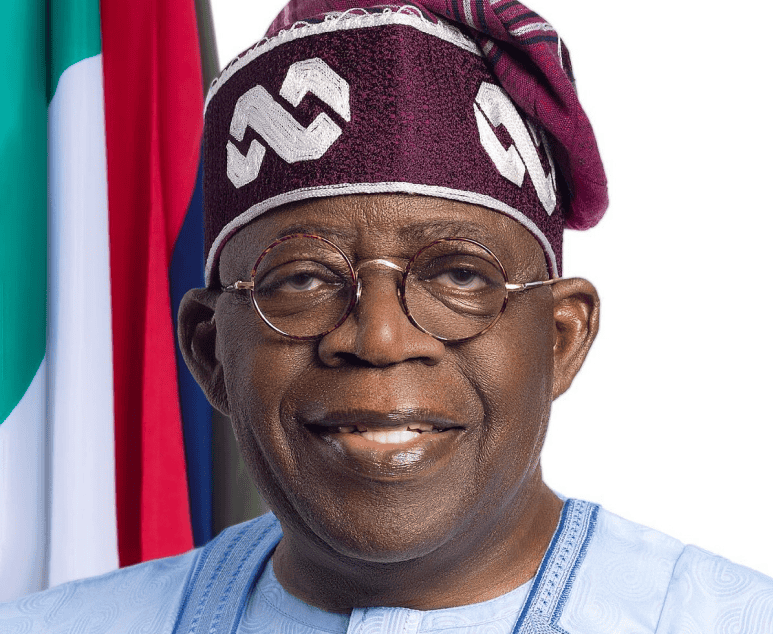

The much-debated tax bills were signed into law by the President on June 26, 2025, and are expected to take effect from January 1, 2026. These Acts (comprising the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service Act, and the Joint Revenue Board Act) represent landmark legislation that marks a major restructuring of Nigeria’s tax landscape. The reforms aim to simplify tax administration, expand the tax base with a view to increasing revenue, and ultimately enhance the ease of doing business in the economy.

Broadening the Tax Base and Enhancing Equity

The reform introduces a progressive shift in corporate and individual taxation. Small companies are granted significant relief, including exemptions from Companies Income Tax, Capital Gains Tax, and the newly created Development Levy. Small companies are defined as entities with an annual turnover not exceeding ₦100 million and total fixed assets below ₦250 million. This exemption not only reduces administrative burdens on micro and small businesses but also encourages formalization within the informal sector. It is expected that this move will unlock the economic potential of Nigeria’s SMEs, contributing positively to employment and overall economic growth.

Personal Income Tax to Reflect Equitable Structure

Personal Income Tax has also been reshaped to reflect a more equitable structure. Income thresholds have been adjusted, exempting individuals earning up to ₦800,000 annually, while high-income earners will be subjected to tax rates up to 25%. This exemption of low-income earners is the first of its kind in the Nigeria’s tax regime. We expect this move to reduce income inequality and possibly increase the purchasing of the bottom of the income pyramid.

Adjustment in VAT Sharing Formular

The VAT sharing formula has been revised to increase subnational entitlements: states now receive 55% and local governments 35%, while the federal share has been reduced to 10%. This aligns fiscal incentives with service delivery closer to the grassroots.

It is important to note that the list of zero-rated items has been broadened to cover essential goods and services such as staple foods, medical and pharmaceutical supplies, educational materials, electricity generation and transmission, medical equipment and services, tuition fees, and non-oil exports.

A New Levy and the End of Certain Incentives

In a move to consolidate levies, increase transparency, and improve tax collection administration, the Acts introduce a new Development Levy set at 4% of assessable profits for companies (excluding small companies) to replace the Tertiary Education Tax, IT Levy, NASENI Levy, and the Police Trust Fund Levy. Also, the Pioneer Status Incentive has been replaced by a new Economic Development Incentive – a 5% tax credit for eligible capital expenditures, valid for five years. This marks a shift from tax holidays to targeted investment stimulation.

Institutional Reforms

On the institutional front, The Federal Inland Revenue Service (FIRS) has been rebranded as the Nigeria Revenue Service (NRS) to better reflect its mandate of assessing, collecting, and managing revenues on behalf of the federation. A framework for joint audits and federal support to subnational governments is also introduced. Additionally, a new Tax Ombuds Office has been created to serve as an independent dispute resolution body, offering taxpayers an alternative to lengthy administrative litigation.

Governance, Disclosure, and Penalties

Transparency and governance are central to the new Acts. Companies are now legally required to disclose tax planning schemes that confer tax advantages, including deferral, avoidance, or exemption strategies. The penalties for non-compliance have been significantly increased. Failure to file returns now attracts an initial ₦100,000 fine, with an additional ₦50,000 for each month of default. A penalty of ₦5 million is also introduced for awarding contracts to unregistered tax entities.

Conclusion

The Nigerian Tax Reform Acts of 2025 represent a fundamental recalibration of the country’s tax policy and administrative structure. This is designed to strengthen the fiscal system, improve transparency, and improve ease of collection and accountability. It is also expected that there would be an upward calibration of business activities, especially in the window of small businesses that have been given tax exemption.

Leave a Reply