Fixed Income Quarterly - Q2 2024

Macro-Economic Overview

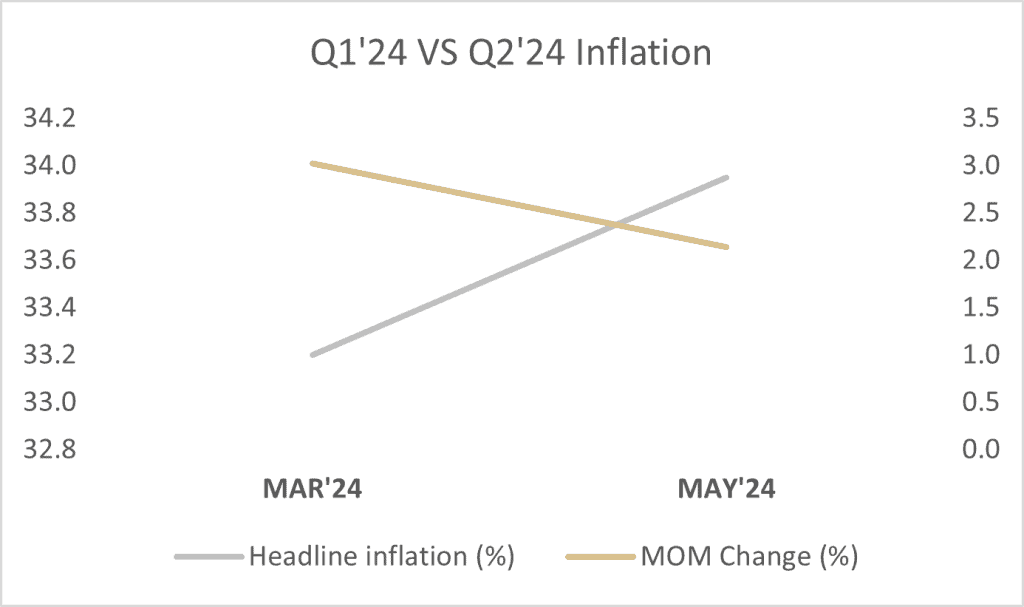

- Nigeria’s inflation increased further, reaching 33.95% level in May, with food inflation at 40.66% and core inflation at 27.04%.

- At the MPC meeting held in May, the committee decided to increase the MPR further by 150bps to 26.25%, in a bid to remain steadfast in achieving price stability. The asymmetric corridor was retained at +100/-300 around the MPR, and the CRR and liquidity ratio was also retained at 45% and 30% respectively.

- Oil prices averaged $85.02/b this quarter, peaking at $91.21/b on the 5th of April. This spike was driven by the heightened geopolitical tensions and potential supply risk.

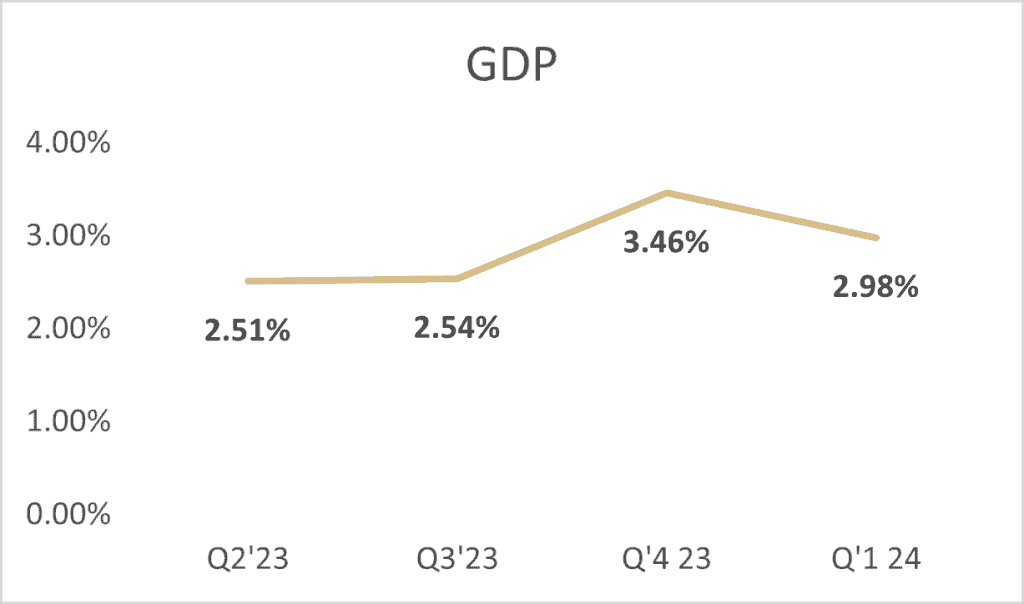

- Nigeria’s Gross Domestic Product (GDP) grew by 2.98% y-o-y (year-on-year) in real terms in Q1’2024, a decline from the 3.46% y-o-y recorded in Q4’2023. The service sector recorded the largest growth of 4.32% for the quarter and contributed 58.04% to the aggregate GDP.

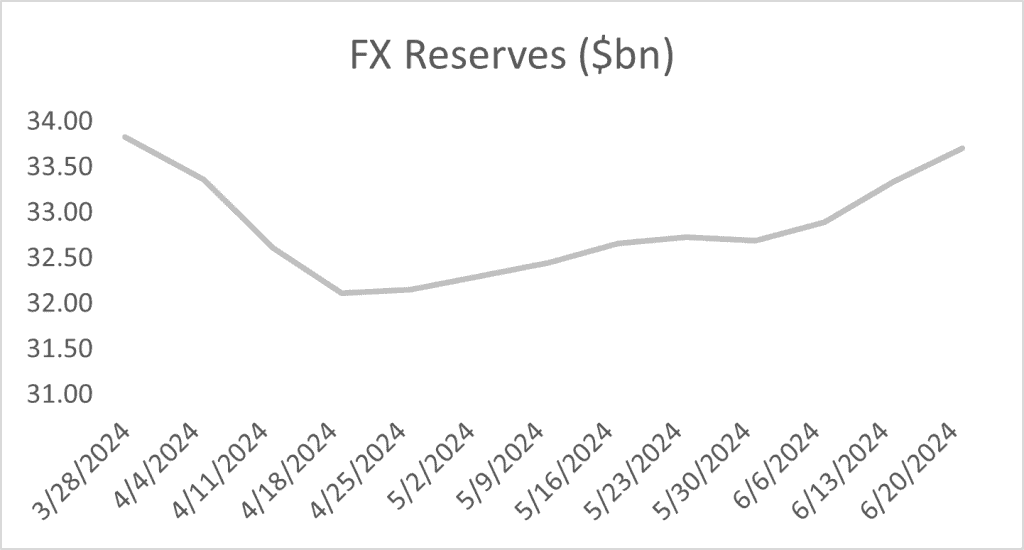

- Coming from Q1, we witnessed a decline in the Nigerian FX reserves this quarter, due to the intervention by the CBN in the parallel market, to support the Naira. We recorded a low of $32.1bn, with a peak at c.$34bn late June. The eventual rise in the reserve can be attributed to increased crude oil prices, diaspora remittances, and foreign portfolio investment.

- Interbank liquidity averaged repo c.N184bn through the quarter, with a high of c.N951bn in late June and a low of repo c.N1.29trn mid-April.

- The Total FAAC disbursement for Q2 stood at c.N4.20trn with April recording the highest at c.N1.87trn.

Market Performance in Q2-2024

Bond market

The Bond market witnessed mixed sentiments through the quarter. Bullish bias commenced the quarter however, following the release of the quarterly bond calendar improved offers were seen across the bond curve. Post auction, buy interests continued, further stimulated by the increased inflation figures. Bullish sentiments continued into the second month, nonetheless, demand waned weeks into the month as players stayed on the sidelines while anticipating the auction and MPC outcome. Towards the end of May, the bond market saw slightly improved offers with a bit of cherry picking across board. Closing the quarter, minimal activity was recorded as players maintained the cautious stance while awaiting the auction for the month. Following the outcome of the auction, the bond yield curve adjusted with profit taking activities seen across board. Q-o-Q yields declined by an average of c.74bps across the curve.

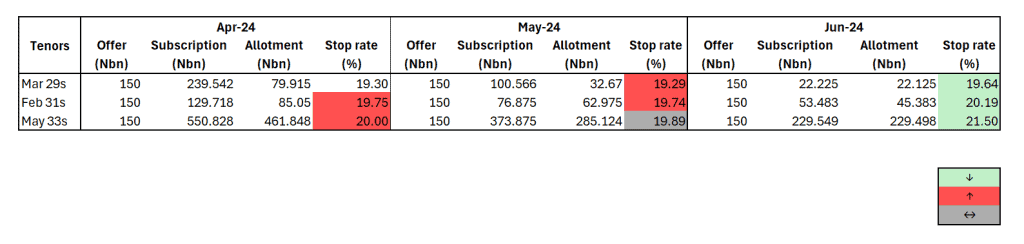

The DMO offered a total of N1.35trn at the bond auctions for the quarter across the 29s, 31s and May 33s. c.N1.3trn was sold through the quarter (vs. N1.78trn sub.), with stop rates closing the quarter at 19.64%, 20.19% and 21.50% respectively.

Treasury bill market

The quarter opened with bearish bias on the back of system illiquidity. This bias continued post first auction, as players took profit especially on the new 1-year paper. However, pockets of demand emerged towards the end of April-2024 as participants looked to take advantage of the market levels. The second month started out with bullish sentiments amid scarce offers as players took on a cautious stance while anticipating the outcome of the MPC meeting. Following the MPC decision and FAAC inflow, demand intensified amid some profit taking activities. In the last month of the quarter, mixed sentiments were witnessed albeit, with a bearish tilt. Mid- month, we witnessed a bit of cherrypicking, albeitthe quarter closed out with the bears taking the centre stage. Q-o-Q, yields increased by an average of c.230bps across the Jul’24-Feb’25 maturities.

The CBN floated seven OMO auctions during the quarter offering c.N3.05trn across the standard tenors. Sales through the quarter was about N2.0trn despite the oversubscriptions recorded at the auctions. Worthy of note is the no sale recorded at the penultimate auction floated in the quarter despite the N321.5b subscription.

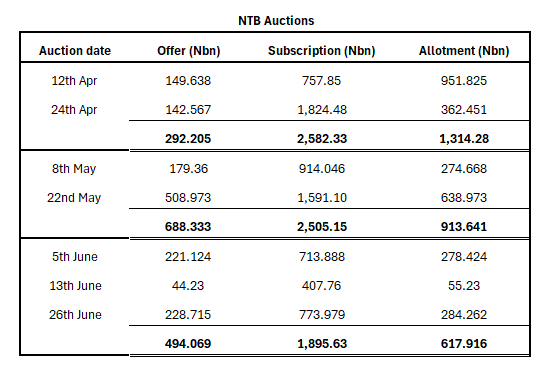

The DMO conducted seven auctions through the quarter with each month recording about 8x . 3.6x, 3.8x oversubscription respectively. In total, the FG oversold c.N1.37trn across the standard tenors. Stop rates remained relatively stable through the quarter, however closing at 16.30% (vs. 16.24% Q1 ending), 17.44% (vs. 17.00% Q1 ending) and 20.68% (vs. 21.124% Q1 ending).

Eurobond Market

The SSA Eurobond market started the year with cautious optimism. The market in Q1 2024 has been influenced by a variety of factors, including global economic trends, geopolitical developments, central bank policies, and domestic economic conditions. Some nations reported improved economic growth and improved fiscal positions, supporting investor confidence in their sovereign bonds, while others grappled with challenges such as high inflation, fiscal deficits, and debt sustainability concerns.

SSA sovereigns faced pressures at the start of 2024 due to fiscal concerns and a stronger dollar from a high interest rate driven by global central bank inflation-fighting policies via rate hikes. African countries are, however, now returning to the international debt capital market to access funds amidst sluggish economic expectations in 2024, as expectations of a possible global rate cut in 2024 continue to support investors’ interest.

Global Economic Factors

The SSA Eurobond market in Q2 2024 continued to be influenced by global economic trends, geopolitical developments, central bank actions, and domestic economic situations in each country. While cautious optimism from Q1 persisted, some headwinds emerged.

Global factors such as the pace of anticipated rate cuts in the United States and ongoing geopolitical tensions, including the Russia-Ukraine war, contributed to market volatility. Inflationary pressures remained a concern, with some SSA countries facing rising prices.

Global Economic Factors:

- The US Federal Reserve’s stance on interest rates continued to be a key driver. The Fed maintained a cautious approach, with one rate cut implemented in May 2024. Further cuts are contingent on inflation data aligning with their target.

- Global economic growth showed signs of slowing down compared to Q1.

- Geopolitical tensions, particularly the ongoing war in Ukraine, continued to disrupt supply chains and exert upward pressure on energy prices.

Country Event

Nigeria

Nigeria’s Eurobond market in Q2 2024 was marked by cautious stability. Key developments included:

- Economic Policies: The Central Bank of Nigeria (CBN) continued efforts to stabilize the forex market and clear NDF backlogs.

- Inflation & Fiscal Concerns: Concerns over inflation and fiscal sustainability persisted as key investor considerations. Fiscal reforms were ongoing, but challenges persisted.

- Market Performance: Yields remained stable, supported by domestic reforms but tempered by inflation concerns.

Ghana

Ghana’s Eurobond market experienced mixed signals in Q2 2024:

- IMF Program: Progress under the IMF Extended Credit Facility continued, with successful reviews boosting investor confidence.

- Inflation: After peaking in early 2023, inflation was on a gradual decline, reaching 23.10% by May 2024.

- Economic Reforms: The government focused on tax reforms and improving state-owned enterprise management to stabilize the economy.

Kenya

Kenya’s Eurobond market continued to be supported by the ongoing implementation of fiscal consolidation plans under the IMF program. The Central Bank of Kenya (CBK) held the policy rate steady at 13.00% throughout Q2. Kenya’s debt buyback program, announced in Q1, concluded successfully, with the government repurchasing a significant portion of its outstanding 2014 Eurobond issue. This move is expected to contribute to improved debt sustainability metrics in the long term. At the end of the quarter, Kenya’s sovereign dollar bonds extended losses after anti-government protests forced President William Ruto to scrap a $2.3 billion plan to balance the budget and make the country’s debt sustainable.

Zambia

Zambia’s economic performance continued to improve in Q2, driven by rising global copper prices and the ongoing implementation of economic reforms. The Kwacha maintained its position as a strong performer, bolstered by previous central bank actions, including a significant hike in reserve ratios and policy rates. Zambia’s debt restructuring efforts under the G-20’s Common Framework neared completion by the close of the quarter, with bondholders overwhelmingly approving the proposed terms. This development is expected to significantly improve Zambia’s creditworthiness and pave the way for renewed market access.

Q3 2024 Outlook

Local Market

In the FGN bond and Bills space, we expect continued bearish stance going into Q3 and to continue in the near term. However, on the back of the c.N2.93 trillion expected in coupon payments and bills maturities through the quarter, we anticipate pockets of cherry picking as participants look to reinvest idle funds.

Eurobond market

- Rate Cuts Anticipation: Investor optimism hinges on potential rate cuts by the US Fed, which could lower risk premiums on SSA papers.

- Country-Specific Outlooks:

- Nigeria: Watch for developments in planned Eurobond issuances and continued economic reforms.

- Ghana: Continued IMF program progress and economic stability are key, with upcoming elections potentially introducing uncertainty.

- Kenya: Success in IMF program implementation and debt management will be crucial for investor confidence.

- Zambia: Rising global copper prices could enhance revenue, while effective inflation control and policy implementation will sustain market interest.