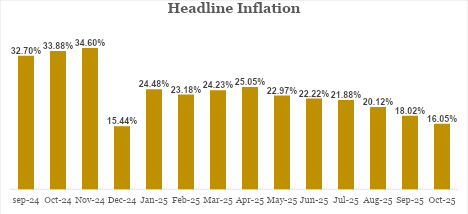

Headline Inflation Moderates to 16.05% in October

The National Bureau of Statistics (NBS) published the October 2025 Consumer Price Index (CPI) report today, showing a continued moderation in inflation. Headline inflation eased further to 16.05%, down from 18.02% in September, marking the 7th consecutive month of decline and the lowest reading in xx months. The persistent moderation in prices reflects the combined impact of favourable base effects, a relatively stable exchange rate environment, and improved domestic food supply driven by the ongoing harvest season.

However, on a month-on-month basis, price pressures edged up slightly, with inflation rising to 0.93% in October from 0.72% in September.

Food Inflation Declines to 13.12%

Food inflation moderated sharply to 13.12% in October from 16.87% in September, marking a significant slowdown in year-on-year price pressures. The deceleration reflects the combined impact of the base-year adjustment, improved market supply due to the peak harvest period, and relative stability in the exchange rate, which helped ease cost pressures on imported food inputs.

However, on a month-on-month basis, food inflation printed at –0.37%, compared with –1.57% in the previous month, indicating a moderation in the pace of monthly food price reductions as the harvest effects begin to wane.

Core Inflation Moderates to 18.69%

Core inflation moderated to 18.69% year-on-year in October, compared with 19.53% in September. Meanwhile, on a month-on-month basis, the core index held steady at 1.42%. The easing in the core basket largely mirrors the effect of a more stable Naira on non-food components.

Outlook

Inflation is expected to continue its gradual downward path in the near term, supported by improving macroeconomic fundamentals. This disinflationary trend will be a key consideration for the Monetary Policy Committee (MPC) at its ongoing meeting. In view of the sustained moderation in price pressures, we anticipate that the MPC may opt for a further 50 bps reduction in the Monetary Policy Rate (MPR).