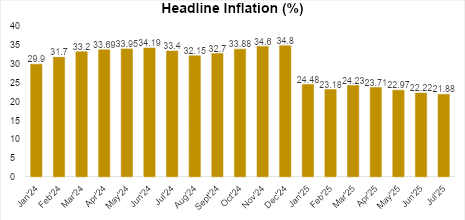

Nigeria’s Inflation Eases to 21.88% in July on FX Stability and Lower Logistics Costs

The National Bureau of Statistics has published the July 2025 Consumer Price Index (CPI) and inflation data, showing a further moderation in headline inflation to 21.88%, down from 22.22% in June. This is in line with consensus expectations and reinforces the recent disinflationary trend. The slowdown was largely driven by favourable base effects and a moderation in underlying price pressures, particularly within the core inflation basket, supported by reduced logistics costs and relative stability in the foreign exchange market, with the Naira trading within a narrow range of ₦1,519.00/$ – ₦1,536.00/$.

However, month-on-month inflation rose to 1.99% in July from 1.68% in June, underscoring a fragile inflation environment still vulnerable to renewed shocks.

Food Inflation Climbs to 22.74%

On a year-on-year basis, food inflation stood at 22.74% in July, representing a 0.77% increase from 21.97% in June. This largely reflects the impact of flooding and insecurity in the food producing states. However, on a month-on-month basis, the food sub-index eased slightly by 0.14% to 3.12%, largely due to the combined effect of the ongoing harvest and reduced logistics costs. The sustained stability in the Naira also helped to contain imported food inflation.

Core Inflation Moderates to 21.33%

Core inflation came in at 21.33% (year-on-year) in July, marking a decline of 1.63% from 22.96% in June. On a month-on-month basis, core inflation fell sharply to 0.97% in July from 2.46% in June 2025. This improvement was supported by relative stability in the foreign exchange market and lower logistics costs.

Outlook

Headline Inflation is expected to continue its gradual moderation in the short term, supported by favourable base effects, improved domestic food supply from the ongoing harvest season, lower logistics costs, and sustained exchange rate stability. However, downside risks persist in the domestic environment from insecurity in key farming regions and structural inefficiencies. This could be compounded by the potential inflationary spillover of Trump’s tariff hikes.