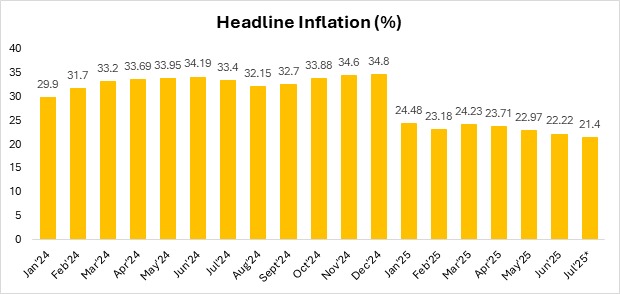

Nigeria's Inflation Projected to Ease Further to 21.4% in July

The National Bureau of Statistics is scheduled to release the July 2025 Consumer Price Index (CPI) and inflation data on August 15, with expectations pointing towards a continued slowdown in price growth. Based on our model, headline inflation is projected to ease to 21.40%, down from 22.22% in June. This would mark the fourth consecutive month of disinflation, signaling the combined effects of favourable base effect, the onset of the harvest season, reduced logistics costs, and relative stability in the foreign exchange market.

Over the past few months, the Naira has traded within a narrow range of ₦1520/$ – ₦1580/$ at the Nigerian Foreign Exchange Market (NFEM) and ₦1524/$ – ₦1589/$ in the parallel market. This exchange rate stability has been underpinned by a combination of stronger foreign portfolio inflows (driven by market-friendly reforms) and improved oil receipts. Nigeria’s crude oil production has consistently averaged above 1.5mbpd in recent months, according to OPEC, supported by intensified measures to curb oil theft and pipeline vandalism.

Month-on-month Inflation Expected to Fall to 1.6%

On a month-on-month basis, inflation is projected to edge lower to 1.60% in July from 1.68% in June. This moderation is expected to be driven by increased food supply from the ongoing harvest season, lower petrol prices, and a stable exchange rate. Notably, the Dangote Refinery reduced its ex-depot petrol price to ₦820 per litre in July from ₦840, prompting a corresponding reduction in pump prices.

Food Inflation Projected to Decline to 21.62%

Food inflation is estimated to ease to 21.62% in July from 21.97% in June, supported by improved agricultural output, lower transportation costs, and sustained Naira stability. While the relatively stable exchange rate should help contain imported inflation pressures, there are concerns about the uptick in the global food price index. According to the Food and Agriculture Organization, the global food price index rose by 1.6% to 130.1 points in July. However, a closer look at the sub-indices shows declines in the cereal and dairy price indices, down 0.8% and 0.1% to 106.5 points and 155.3 points, respectively. Given their significant weight in Nigeria’s food import basket, these declines, combined with exchange rate stability, are likely to provide additional relief to domestic food price pressures.

Core Inflation to Ease to 21.81%

Core inflation is anticipated to decline to 21.81% in July from 22.76% in June, reflecting the positive impact of relative stability in the foreign exchange market. The reduced volatility in the Naira has helped ease imported inflationary pressures, particularly for non-food goods such as manufactured products, household appliances, and pharmaceuticals, which are sensitive to exchange rate fluctuations. In addition, the moderation in logistics costs and the absence of significant price shocks in key non-food sectors during the month provided further support to price stability in the core basket.

Outlook

Looking ahead, the near-term inflation trajectory will largely hinge on exchange rate stability, global commodity price trends, and domestic food supply dynamics. While favourable base effects are expected to persist in the coming months, sustaining lower month-on-month readings will be key to consolidating the disinflation trend. Continued improvement in crude oil production and higher capital inflows could help strengthen the Naira further, easing imported inflation pressures. Nonetheless, risks remain from adverse weather impacts on agriculture, the potential inflationary spillover of Trump’s tariff hikes, and fluctuations in global oil prices.