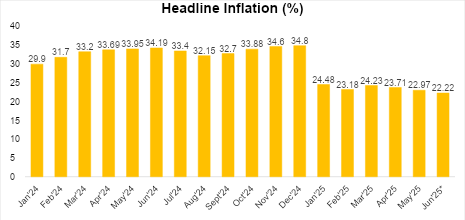

Headline Inflation Falls to 22.22% in June

Nigeria’s headline inflation moderated for the third consecutive month in June, easing to 22.22% year-on-year from 22.97% in May. This closely aligns with our forecast of 22.37% and reflects a continuation of the disinflation trend that began in Q2.

The moderation in year-on-year inflation can be partly attributed to base effects, given the sharp rise in prices during the same period in 2024. The decline also reflects broader economic conditions. Consumer spending remains subdued, as households continue to grapple with reduced purchasing power. This has dampened demand across many sectors, especially for non-essential goods and services, where businesses are encountering greater resistance to price increases. In addition, relative exchange rate stability and some easing in domestic energy costs have helped mitigate cost-push pressures across production and distribution chains.

Disconnect Between Headline Inflation and Sub-Indices

While the sustained decline in headline inflation is welcome news for policy makers and market participants, there appears to be a disconnect between the headline figure and key sub-indices. Year-on-year food and core inflation rose to 21.97% and 22.76%, respectively, up from 21.14% and 22.28% in the previous month.

Month-on-month inflation also edged higher to 1.68% in June, compared to 1.53% in May, driven mainly by a temporary spike in fuel prices mid-month following a rebound in global oil markets amid heightened geopolitical tensions.

Outlook: Disinflation to Continue, But Risks Persist

Looking ahead, we expect the disinflation trend to extend into the third quarter, supported by seasonal improvements in food supply and the broader impact of ongoing macroeconomic reforms. The commencement of the harvest season should ease pressure on food prices, which remain the dominant driver of the consumer price basket.

Meanwhile, policy-driven improvements in market confidence, especially around exchange rate management and fiscal consolidation, are supporting a more stable external environment. Increased capital inflows have begun to strengthen FX liquidity and reduce the risk of imported inflation.

Externally, the recent decision by the U.S. administration to extend the suspension of trade tariffs until August 1 has helped calm global markets in the short term. However, renewed tensions or further escalation remain a major risk. For Nigeria, a disruption in global trade flows or a resurgence in commodity price volatility could filter through to domestic inflation via input costs and supply chain pressures.

MPC Outlook: Inflation Trend Strengthens Dovish Case, But Caution to Prevail

The June inflation data came in just ahead of the Central Bank of Nigeria’s Monetary Policy Committee (MPC) meeting scheduled for next week. With inflation trending downward for a third straight month, dovish members of the committee will likely see a growing case for monetary easing.

Market signals already reflect this sentiment. Yields on OMO bills and treasury instruments have started to decline in recent weeks, as investors anticipate a potential policy pivot. A rate cut could help lower borrowing costs and stimulate domestic demand, which remains weak across much of the economy.

However, we expect the committee to proceed cautiously. Despite the recent decline in inflation, global risks remain elevated, particularly the looming August 1 tariff deadline. Further tightening in global conditions or renewed volatility in commodity markets could undermine recent progress on the inflation front.

Given this backdrop, the MPC is likely to adopt a balanced tone, acknowledging the improved inflation outlook while holding rates steady to preserve macroeconomic stability and monitor how external developments evolve.