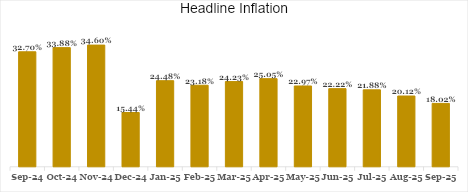

Inflation Slows to 18.02% as the Naira Holds Its Ground

Nigeria’s inflation continued its downward trajectory in September 2025, falling for the sixth consecutive month to 18.02% year-on-year, from 20.12% in August, according to the National Bureau of Statistics (NBS). This marks the sharpest pace of disinflation in over a year, signaling a gradual return to price stability on the back of favourable base effects, enhanced supply dynamics, and policy reforms (which has helped to bolster investor confidence, boost FX liquidity and stabilize the exchange rate). On a month-on-month basis, the consumer price index rose by 0.72%, moderating further from 1.06% in August, as price growth slowed across key components of the index.

Inflation Breakdown

Food Falls to 16.87% on Naira Stability & Harvest Impact

In September, food inflation eased to 16.87% year-on-year from 21.87% in August, while on a month-on-month basis, it recorded a negative print of -1.57%, down from 1.65% in August. This reflects a combination of improved domestic food supply during the harvest season and reduced import pass-through amid naira stability. Notably, prices of key staples such as maize, garri, beans, tomatoes, and onions declined across major markets. However, regional disparities persist, with some northern states still grappling with localized food price spikes due to insecurity and limited market access.

Monthly Core Inflation Suggests Underlying Cost Pressures

Core inflation, which excludes volatile food and energy items, slowed to 19.53% year-on-year in September from 20.33% in August. However, on a month-on-month basis, it was relatively flat at 1.42% compared to 1.43% in August, driven by increases in housing, utilities, healthcare, and transport costs. The continued stickiness in monthly core inflation suggests that underlying cost pressures are yet to ease significantly.

Sustained Disinflation Strengthens the Case for Further Monetary Easing

The sustained slowdown in inflation strengthens the case for a measured recalibration of monetary policy by the Central Bank of Nigeria (CBN). With inflation trending downward and exchange rate pressures easing, there is a clearer path toward a gradual monetary easing cycle. Nonetheless, the stickiness in monthly core inflation suggests that the Monetary Policy Committee (MPC) will remain cautious, balancing the need to support growth while consolidating disinflation gains.

For investors, the evolving inflation landscape carries strategic implications. Declining inflation and expectations of monetary easing would exert downward pressure on fixed-income yields, driving a potential rotation toward medium to long duration instruments. The improving macro stability and moderation in price pressures could also support renewed interest in equities, particularly within consumer goods and infrastructure-linked sectors, where real returns may begin to improve as purchasing power recovers.

Conclusion

The September inflation data reaffirms Nigeria’s transition from volatility to cautious stability. The consistent disinflation trend, anchored by FX stability, improved agricultural supply, amongst other factors, signals meaningful progress toward price normalization. However, sustaining this trend will require continuous structural reforms to ensure that disinflation becomes both durable and broad-based. This is likely to push inflation closer to 15%-band by year-end, setting the stage for a more stable and growth-supportive macroeconomic environment.